Join Steve LaFrance, CFP® with Blakely Financial as he updates you on the last 3 months in 3 minutes.

Join Steve LaFrance, CFP® with Blakely Financial as he updates you on the last 3 months in 3 minutes.

Donna Blakely recently volunteered with the Junior League of High Point and helped teach a Crock-Pot cooking class at the YWCA to young moms. It was an educational workshop that included healthy eating focused on the nutritional needs of women and children. The JLHP provided each participant with a crock-pot, recipe book, and ingredients to help these moms recreate the meal at home that was demonstrated to them during the class. Anytime there is food and cooking involved, Donna loves to help out!

Presented by Robert Blakely, Emily Promise, and Steve LaFrance

The next phase in the Russia-Ukraine crisis has begun, as Russia has launched attacks on Ukraine. With a war underway, it’s unsurprising that the markets are reacting. Before the market opened on Thursday, U.S. stock futures were down between 2 1/2 percent and 3 1/2 percent, while gold was up by roughly the same amount. In addition, the yield on 10-Year U.S. Treasury securities has dropped sharply. International markets were down even more than the U.S. markets, as investors fled to the more comfortable haven of U.S. securities.

News of the invasion is hitting the markets hard right now, but the real question is whether that hit will last. It probably will not. History shows the effects are likely to be limited over time. In retrospect, this event is not the only time we have seen military action in recent years. And it’s not the only time we’ve seen aggression from Russia. In none of these cases were the effects long-lasting.

Let’s look back at the Russian invasion of Georgia and the Russian takeover of Crimea, which is part of Ukraine. In August 2008, Russia invaded the Republic of Georgia. The U.S. markets dropped by about 5 percent, then rebounded to end the month even. Then, in February and March 2014, Russia invaded and annexed Crimea. Again, the U.S. markets dropped about 6 percent on the invasion but rallied to end March higher. In both of these cases, the initial market drops were erased quickly.

We essentially see the same pattern when looking at a broader range of events. For example, the chart below shows market reactions to other acts of war, both with and without U.S. involvement. Historically, the data shows a short-term pullback—as we will likely see today—followed by a bottom within the next couple of weeks. Exceptions include the 9/11 terrorist attacks, the Iraqi invasion of Kuwait, and, looking further back, the Korean War and Pearl Harbor attacks.

Still, even with these exceptions, the market reaction was limited both on the day of the event and during the overall time to recovery. Moreover, comparing the data provides valuable context for recent events. For example, as tragic as the invasion of Ukraine is, its overall effect will likely be much closer to that of the Russian invasion of Ukraine in 2014, in which Russia annexed Crimea than it will be to the aftermath of 9/11.

But even with the short-term effects discounted, should we fear that somehow the war or its impact will derail the economy and markets? Here, too, the historical evidence is encouraging, as demonstrated by the chart below. Returns during wartime have historically been better than all returns, not worse. Although the war in Afghanistan is not included in the chart, it too matches the pattern. During the first six months of that war, the Dow gained 13 percent, and the S&P 500 gained 5.6 percent.

Sources: The indices used for each asset class are as follows: the S&P 500 Index for large-Cap stocks; CRSP Deciles 6-10 for small-cap stocks; long-term U.S. government bonds for long-term bonds; five-year U.S. Treasury notes for five-year notes; long-term U.S. corporate bonds for long-term credit; one-month Treasury bills for cash; and the Consumer Price Index for inflation. All index returns are total returns for that index.

Returns for a wartime period are calculated as the index’s returns four months before the war and during the entire war itself. Returns for “All Wars” are the annualized geometric return of the index over all “wartime periods.” Risk is the annualized standard deviation of the index over the given period. Past performance is not indicative of future results.

This data is not presented to say that the Russia-Ukraine crisis won’t bring real effects and hardship. Oil prices are up to levels not seen since 2014, which was the last time Russia invaded Ukraine. Higher oil and energy prices will hurt economic growth and drive inflation worldwide, especially in Europe and the U.S. This environment will be a headwind as we advance.

Will we see effects from the headwind caused by the Ukraine invasion? Very likely. Will they derail the economy? Not likely at all. During recent waves of Covid-19, the U.S. economy demonstrated substantial momentum, which should move us through the current headwind until markets normalize. Moreover, as has happened before, we already see U.S. production increase, which should help bring prices back down.

The Ukraine invasion has created current market turbulence; we should look at what history tells us. First, past conflicts have not derailed either the economy or the markets over time. Historically, the U.S. has survived and even thrived during wars.

Although the current events with the Russia-Ukraine crisis have unique elements, they’re more of what we’ve seen in the past. Events like yesterday’s invasion do come along regularly. Part of successful investing—sometimes the most challenging—is not overreacting. If you’re comfortable with the risks you’re taking, you might not be making any changes—except perhaps to start looking for some stock bargains. Consider whether your portfolio allocations are at a comfortable risk level if you’re worried. If they’re not, talk to your advisor.

This material is intended for informational/educational purposes only. It should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Dow Jones Industrial Average (‘the Dow’) is a price-weighted measurement stock market index of 30 prominent companies listed on stock exchanges in the United States.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other expert advice we can provide towards your financial well-being.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Diversification and asset allocation programs do not assure a profit or protect against loss in declining markets, and cannot guarantee that any objective or goal will be achieved.

Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, at Commonwealth Financial Network®.

© 2022 Commonwealth Financial Network®

You’ve been doing the right thing financially for many years, saving for your child’s education and your retirement. Yet now, as both goals loom in the years ahead, you may wonder what else you can do to help your child (or children) receive a quality education without compromising your own retirement goals.

Start by reviewing the financial aid process and understanding how financial need is calculated. Colleges and the federal government use different formulas to determine need by looking at a family’s income (the most crucial factor), assets, and other household information.

A few key points:

Financial aid takes two forms: need-based aid and merit-based aid. Although middle- and higher-income families typically have a more challenging time receiving need-based aid, there are some ways to reposition your finances to potentially enhance eligibility:

Many colleges use merit-aid packages to attract students, regardless of financial need. As your family explores colleges in the years ahead, be sure to investigate merit-aid opportunities as well. A net price calculator, available on every college website, can give you an estimate of how much financial aid (merit- and need-based) your child might receive at a particular college.

What if you’ve done all you can and still face a sizable gap between how much college will cost and how much you have saved? To help your child graduate with as little debt as possible, you might consider borrowing or withdrawing funds from your retirement savings. Though tempting, this is not an ideal move. While your child can borrow to finance their education, you generally cannot take a loan to fund your retirement. If you make retirement savings and debt reduction (including a mortgage) a priority now, you may be better positioned to help your child repay any loans later.

Some Parents Use Retirement Funds to Pay for College

Source: Sallie Mae, 2021

Consider speaking with a financial professional about how these strategies may help you balance these two challenging and important goals. Of course, there is no assurance that working with a financial professional will improve investment results.

Withdrawals from traditional IRAs and most employer-sponsored retirement plans are taxed as ordinary income. They may be subject to a 10% penalty tax if taken before age 59½ unless an exception applies. (IRA withdrawals used for qualified higher-education purposes avoid the early-withdrawal penalty.)

1) College Savings Plan Network, 2021

Financing a college education with the least debt involves putting together various resources in the most favorable way for your family. It requires planning, savings discipline, an understanding of financial aid, innovative college research, and good decision making at college time.

Your savings are the cornerstone of any successful college financing plan. It’s helpful to think of your college savings as a down payment on the total cost, similar to a down payment on a home. Then, you can supplement your savings with other available resources at college time.

Setting aside money for college over many years takes discipline, and in many cases, sacrifice, including lifestyle changes. Of course, every family’s situation is different. But if you save regularly over time, you might be surprised at how much you could accumulate in your college fund.

Financial aid is the next piece of the puzzle. It’s a broad term that can mean many things, with concepts that are often used interchangeably. At its core, financial aid is money to help pay for college: loans, grants, scholarships, and work-study. Your overall goal is to get the most grants and scholarships (grant aid) and the least amount of loans.

Colleges are the largest source of grant aid, with annual need-based and merit-based grant awards that can be in the tens of thousands of dollars. By contrast, the federal government’s two central grants, the Pell Grant and the Supplemental Educational Opportunity Grant, are generally smaller and reserved for students with the greatest financial need.

To help find colleges with the most generous grant aid, use a net price calculator available on every college website. A net price calculator estimates how much grant aid a student might expect based on their financial information and academic profile. By completing a net price calculator for several colleges, you can compare what your out-of-pocket cost (net price) might be at different schools and rank colleges based on affordability.

The federal government’s main contribution to the world of financial aid is student loans. Regardless of financial need, all students are eligible for federal student loans.

Other potential resources at college time might help reduce the overall amount you’ll need to borrow: what you can contribute from current income during the college years; your child’s earnings from a school or summer job; education tax credits, which could be worth up to $2,500 per year; financial help from grandparents or other relatives; and scholarships from civic, private, or nonprofit groups.

On the cost-cutting side, your child might consider graduating in less than four years; attending community college for two years and then transferring to a four-year college; becoming a resident assistant to get free or discounted room and board; living at home for a semester or two; exploring all in-state public college options, and deferring enrollment for a year to earn money and take advantage of any employer educational assistance.

After taking everything into account — the amount of your college fund, the grant aid your child might receive at specific colleges, the amount of money you and your child can contribute from current income during the college years, and the availability of other resources and cost-cutting measures — you can determine how much borrowing would be required for specific colleges and make an informed choice.

Borrowing money to pay for college can quickly spiral out of control. Make sure your child understands the monthly payment for different loan amounts over a 10-year repayment term. If the numbers look daunting, don’t be afraid to say “no” to specific colleges. Unfortunately, most teenagers experienced in finance enough to understand the negative consequences of excessive borrowing fully, so it’s up to parents to help eliminate options that aren’t economically viable.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to ensure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

During your working years, you’re accustomed to living on an income from your job. However, when you retire, the income from employment ends. Social Security provides a steady income, but it probably isn’t enough to meet your retirement income needs. An annuity is an option that can provide a stream of income during retirement.

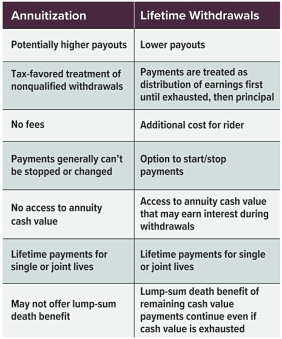

There are usually two choices available to generate a steady income with most annuities: annuitization and lifetime withdrawals from a guaranteed lifetime withdrawal benefit. Here’s how each option works.

This is a fancy word to describe converting funds in an annuity into a stream of income for a fixed period or a lifetime. Often, once the annuity is annuitized, it can’t be changed, reversed, or revoked — you’re pretty much locked into the payments for the duration of time chosen.

The amount of annuitization payments is based on several factors, including the duration of the annuity payments (either a fixed period or lifetime), the cash value of the annuity, current interest rates applied by the annuity issuer, and the age of the person (referred to as the “annuitant”) over whose life the payments are based. With annuitization payments from nonqualified annuities (i.e., annuities funded with after-tax dollars), each distribution consists of two components: principal (a return of the money paid into the annuity) and earnings. The percentages of principal and earnings for each distribution will depend on the annuitization option chosen.

A guaranteed lifetime withdrawal benefit (GLWB) enables the annuity owner to receive payments without having to annuitize the annuity or give up access to the remaining cash value in the annuity. Typically, an annual fee is charged for a GLWB.

The amount of the GLWB payment is usually determined by applying a withdrawal percentage to the annuity’s principal amount or cash value, whichever is greater at the time of election. Then, the amount of each withdrawal is subtracted from the cash value. Generally, the withdrawal amount will not decrease, even if the cash value decreases or is exhausted. However, optional benefits are available for an additional fee and are subject to contractual terms, conditions, and limitations as outlined in the prospectus and may not benefit all investors.

Annuities are designed to be long-term investment vehicles. Generally, annuity contracts have fees, expenses, limitations, exclusions, holding periods, termination provisions, and terms for keeping the annuity in force. Surrender charges may be assessed during the early years of the contract if the annuity is surrendered. Withdrawals prior to age 59½ may be subject to a 10% federal income tax penalty. Any annuity guarantees are contingent on the financial strength and claims-paying ability of the issuing insurance company. Annuities are not insured by the FDIC or any other government agency; they are not deposits of, nor are they guaranteed or endorsed by, any bank or savings association.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to ensure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

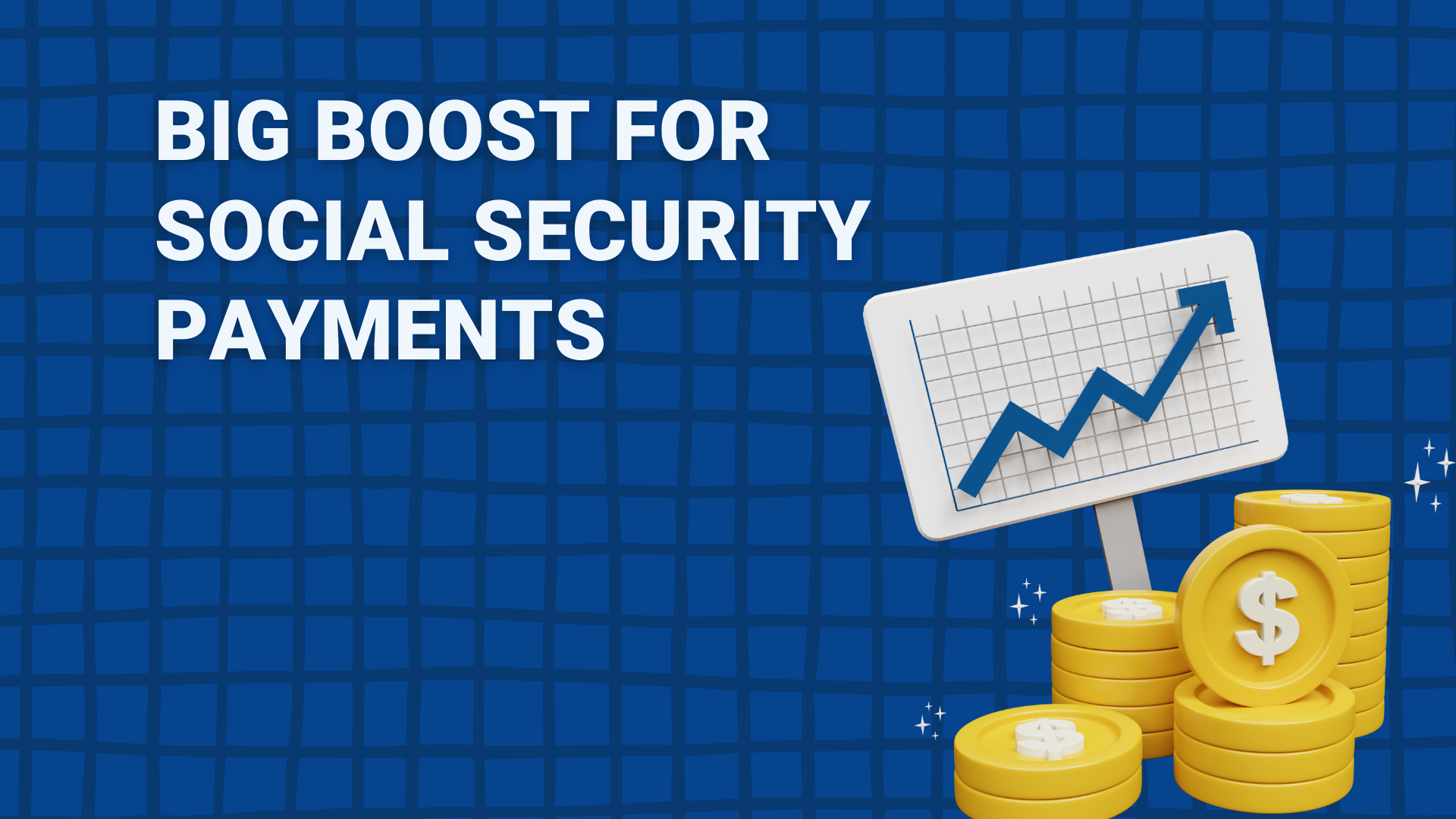

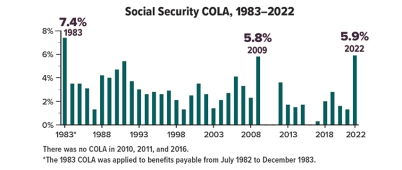

The Social Security cost-of-living adjustment (COLA) for 2022 is 5.9%, the most significant increase since 1983. The COLA applies to December 2021 benefits, payable in January 2022. The amount is based on the rise in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from Q3 of the last year a COLA was determined to Q3 of the current year (in this case, Q3 2020 to Q3 2021).

Despite these annual adjustments for inflation, a recent study found that the buying power of Social Security benefits declined by 30% from 2000 to early 2021, in part because the CPI-W is weighted more heavily toward items purchased by younger workers than by Social Security beneficiaries.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to ensure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Contributing to an employer-sponsored retirement plan or an IRA is a big step on the road to retirement, but contributing to both can significantly boost your retirement assets. A recent study found that, on average, individuals who owned both a 401(k) and an IRA at some point during the six years of the survey had combined balances about 2.5 times higher than those who owned only a 401(k) or an IRA. And people who owned both types of accounts consistently over the period had even higher balances.1

Here is how the two types of plans can work together in your retirement savings strategy.

Convenience vs. Control

Employer-sponsored plans such as 401(k), 403(b), and 457(b) plans offer a convenient way to save through pre-tax salary deferrals, and contribution limits are high: $19,500 in 2021 ($20,500 in 2022) and an additional $6,500 if age 50 or older. Although the costs for investments offered in the plan may be lower than those provided in an IRA, these plans typically offer limited investment choices and have restrictions on control over the account.

IRA contribution limits are much lower: $6,000 in 2021 and 2022 ($7,000 if age 50 or older). But you can usually choose from a wide variety of investments, and the account is yours to control and keep regardless of your employment situation. For example, if you leave your job, you can roll assets in your employer plan into your IRA.2. In contrast, contributions to an employer plan generally must be made by December 31; you can contribute to an IRA up to the April tax filing deadline.

Matching and Diversification

Many employer plans match a percentage of your contributions. If your employer offers this program, it would be wise to contribute enough to receive the entire match. Of course, contributing more would be better, but you also might consider funding your IRA, especially if the contributions are deductible (see below).

Along with the flexibility and control offered by the IRA, holding assets in both types of accounts, with different underlying investments, could help diversify your portfolio. Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss.

Rules and Limits

Although annual contribution limits for employer plans and IRAs are separate, your ability to deduct traditional IRA contributions phases out at higher income levels if you are covered by a workplace plan: modified adjusted gross income (MAGI) of $66,000 to $76,000 for single filers and $105,000 to $125,000 for joint filers in 2021 ($68,000 to $78,000 and $109,000 to $129,000 in 2022).3 You can make nondeductible contributions to a traditional IRA regardless of income.

Eligibility to contribute to a Roth IRA phases out at higher income levels regardless of coverage by a workplace plan: MAGI of $125,000 to $140,000 for single filers and $198,000 to $208,000 for joint filers in 2021 ($129,000 to $144,000 and $204,000 to $214,000 in 2022).

Source: Investment Company Institute, 2021

Contributions to employer-sponsored plans and traditional IRAs are generally made pre-tax or tax-deductible and accumulate tax-deferred. Distributions are taxed as ordinary income and may be subject to a 10% federal income tax penalty if withdrawn before age 59½ (with certain exceptions). Nondeductible contributions to a traditional IRA are not taxable when withdrawn, but any earnings are subject to ordinary income tax. Required minimum distributions (RMDs) from employer-sponsored plans and traditional IRAs must begin for the year you reach age 72 (70½ if you were born before July 1, 1949). However, you are generally not required to take distributions from an employer plan as long as you still work for that employer.

Roth IRA contributions are not deductible, but they can be withdrawn at any time without penalty or taxes. To qualify for the tax-free and penalty-free withdrawal of earnings, Roth IRA distributions must meet a five-year holding requirement and take place after age 59½ (with certain exceptions). Original owners of Roth IRAs are exempt from RMDs. However, beneficiaries of all IRAs and employer plans must take RMDs based on their age and relationship to the original owner.

1) Employee Benefit Research Institute, 2020

2) Other options when separating from an employer include leaving the assets in your former employer’s plan (if allowed), rolling them into a new employer’s plan, or cashing out (usually not wise).

3) If a workplace plan does not cover you, but your spouse is covered, eligibility phases out at MAGI of $198,000 to $208,000 for joint filers in 2021 ($204,000 to $214,000 in 2022).

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to ensure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Charitable Giving Can Be a Family Affair

As families grow in size and overall wealth, a desire to “give back” often becomes a priority. Cultivating philanthropic values can help foster responsibility and a sense of purpose among young and old alike while providing financial benefits. In addition, charitable donations may be eligible for income tax deductions (if you itemize) and can help reduce capital gains and estate taxes. Here are four ways to incorporate charitable giving into your family’s overall financial plan.

Annual Family Giving

The holidays present a perfect opportunity to help family members develop a giving mindset. To establish an annual family giving plan, first determine the total amount that you’d like to donate as a family to charity. Next, encourage all family members to research and make a case for their favorite nonprofit organization, or divide the total amount equally among your family members and have each person donate to their favorite cause.

When choosing a charity, consider how efficiently the contribution dollars are used — i.e., how much of the organization’s total annual budget directly supports programs and services versus overhead, administration, and marketing. For help in evaluating charities, visit the Charity Navigator website, charitynavigator.org, where you’ll find star ratings and more detailed financial and operational information.

Snapshot of 2020 Giving

Despite the pandemic and economic downturn, 2020 was the highest year for charitable giving on record, reaching $471.44 billion. Giving to public-society benefit organizations, environmental and animal organizations, and human services organizations grew the most while giving to arts, culture, and humanities and health organizations declined.

Source: Giving USA 2021

Estate Planning

Charitable giving can also play a vital role in an estate plan by helping to ensure that your philanthropic wishes are carried out and potentially reducing your estate tax burden.

The federal government taxes wealth transfers both during your lifetime and at death. In 2021, the federal gift and estate tax is imposed on lifetime transfers exceeding $11,700,000, at a top rate of 40%. States may also impose taxes but at much lower thresholds than the federal government.

Ways to incorporate charitable giving into your estate plan include will and trust bequests; beneficiary designations for insurance policies and retirement plan accounts; and charitable lead and charitable remainder trusts. (Trusts incur upfront costs and often have ongoing administrative fees. The use of trusts involves complex tax rules and regulations. Before implementing such strategies, you should consider the counsel of an experienced estate planning professional and your legal and tax professionals.)

Donor-Advised Funds

Donor-advised funds offer a way to receive tax benefits now and make charitable gifts later. A donor-advised fund is an agreement between a donor and a host organization (the fund). Your contributions are generally tax-deductible, but the organization becomes the legal owner of the assets. You (or a designee, such as a family member) then advise on how those contributions will be invested and how grants will be distributed. (Although the fund has ultimate control over the assets, the donor’s wishes are generally honored.)

Family Foundations

Private family foundations are similar to donor-advised funds but on a more complex scale. Although you don’t necessarily need the coffers of Melinda Gates or Sam Walton to establish and maintain one, a private family foundation may be most appropriate if you have a significant level of wealth. The primary benefit (in addition to potential tax savings) is that you and your family have complete discretion over how the money is invested and which charities will receive grants. A drawback is that these separate legal entities are subject to stringent regulations.

These are just a few ways families can nurture a philanthropic legacy while benefitting their financial situation. For more information, contact your financial professional or an estate planning attorney.

Happy Thanksgiving to all our clients and friends! We’re proud to serve you. Tune in for a message from Robert Blakely and our team!