During your working years, you’re accustomed to living on an income from your job. However, when you retire, the income from employment ends. Social Security provides a steady income, but it probably isn’t enough to meet your retirement income needs. An annuity is an option that can provide a stream of income during retirement.

There are usually two choices available to generate a steady income with most annuities: annuitization and lifetime withdrawals from a guaranteed lifetime withdrawal benefit. Here’s how each option works.

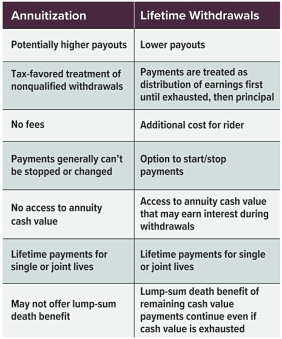

Annuitization

This is a fancy word to describe converting funds in an annuity into a stream of income for a fixed period or a lifetime. Often, once the annuity is annuitized, it can’t be changed, reversed, or revoked — you’re pretty much locked into the payments for the duration of time chosen.

The amount of annuitization payments is based on several factors, including the duration of the annuity payments (either a fixed period or lifetime), the cash value of the annuity, current interest rates applied by the annuity issuer, and the age of the person (referred to as the “annuitant”) over whose life the payments are based. With annuitization payments from nonqualified annuities (i.e., annuities funded with after-tax dollars), each distribution consists of two components: principal (a return of the money paid into the annuity) and earnings. The percentages of principal and earnings for each distribution will depend on the annuitization option chosen.

Guaranteed Lifetime Withdrawal Benefit

A guaranteed lifetime withdrawal benefit (GLWB) enables the annuity owner to receive payments without having to annuitize the annuity or give up access to the remaining cash value in the annuity. Typically, an annual fee is charged for a GLWB.

The amount of the GLWB payment is usually determined by applying a withdrawal percentage to the annuity’s principal amount or cash value, whichever is greater at the time of election. Then, the amount of each withdrawal is subtracted from the cash value. Generally, the withdrawal amount will not decrease, even if the cash value decreases or is exhausted. However, optional benefits are available for an additional fee and are subject to contractual terms, conditions, and limitations as outlined in the prospectus and may not benefit all investors.

Annuities are designed to be long-term investment vehicles. Generally, annuity contracts have fees, expenses, limitations, exclusions, holding periods, termination provisions, and terms for keeping the annuity in force. Surrender charges may be assessed during the early years of the contract if the annuity is surrendered. Withdrawals prior to age 59½ may be subject to a 10% federal income tax penalty. Any annuity guarantees are contingent on the financial strength and claims-paying ability of the issuing insurance company. Annuities are not insured by the FDIC or any other government agency; they are not deposits of, nor are they guaranteed or endorsed by, any bank or savings association.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to ensure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.