Presented by ROBERT BLAKELY, CFP®, AIF®, CHFC®

Caring for aging parents can be a difficult planning aspect to balance. If you are among the “sandwich generation,” you may be trying to support your aging parents as well as your own children. Today, individuals are living longer than before, so it is better to be prepared.

Having the Conversation

The first step—and often the most challenging one—is to find out what your parent needs or expects from you. It’s always best to have this conversation before a crisis occurs. Also, keep in mind that your parent may resist discussing the topic at first. He or she has lived a long time without much assistance from you, and the transition to accepting your new role in his or her life may be bumpy. Understanding and respecting your parent’s wishes will go a long way toward smoothing the process. How will your parent deal with incapacity, the fear of becoming dependent, or the reluctance to burden you with his or her needs?

Gathering Information and Documents

Create a list of emergency contact numbers, including your parent’s medical providers; religious leader; neighbors; friends; and financial, tax, and legal advisors. You should also gather copies of legal documents, funeral plans, medical records, and medication information. Keep a list of investment, bank, and insurance accounts, in addition to the locations of safe deposit boxes, real estate deeds, and automobile titles. You may find it helpful to upload all of this information to a USB flash drive so that it’s readily available when you need it.

Evaluating Your Parent’s Situation

It may be difficult for you to evaluate your parent’s mental and physical capabilities or to locate community services to support his or her independence. If that’s the case, a geriatric care manager can be indispensable, particularly if you live some distance from your parent. This person can perform an in-home assessment, determine your parent’s housing needs, and recommend a plan of action. Your parent’s doctor should be able to refer you to a qualified geriatric care manager.

Can your parent remain at home? Just because your parent can no longer care for his or her home doesn’t mean that he or she has to move. In fact, staying in one’s home may offer better support and social networks than moving in with one’s children. If your parent can stay safely alone, you may want to divide up the household chores among family members or hire someone to provide housekeeping, cooking, and personal care. Here are a few other items to consider:

- Find out if Meals on Wheels is available in your area. The organization’s volunteers deliver meals to seniors who can no longer cook for themselves.

- Look into modifying your parent’s home to help with any physical limitations.

- Install a security system to summon emergency personnel if necessary.

- Call the local police department to find out if it offers a program to check on elderly residents. If not, churches often have a volunteer group dedicated to checking in on older parishioners.

- Post important telephone numbers for contacting you, emergency services, and your parent’s doctor in a prominent location.

As your parent grows older, an assisted living facility or retirement community may be a better solution than living at home. Such residences provide additional benefits, such as transportation, access to medical personnel, and a richer social life.

Can your parent move in with family? Another solution is moving mom or dad into your home. This is a big decision, and it may not be the best choice for every family. Ask yourself:

- Will living together put stress on your relationship with your parent or on your relationship with your family?

- Can you afford to remodel your home to provide a comfortable and private environment for your parent?

- Do you have the flexibility to provide transportation as needed?

- Will other family members step in to help, both financially and physically?

- Will other family members share the cost of adult day care?

Can your parent continue to drive? If your parent is older than age 75, takes medications, or both, his or her ability to drive a car may be impaired. Of course, it’s difficult to know when older drivers have become a danger to themselves or others. Give your parent’s friends and neighbors your contact information and ask them to make you aware of any changes in his or her driving skills. Or suggest that your parent accompany you for grocery shopping and other errands rather than driving alone. Many communities offer driver’s education courses that teach best practices for seniors (e.g., limiting drive time to daylight hours and good weather conditions, avoiding highway or high-traffic situations).

Keep in mind that this may be a very sensitive topic for your parent. Many seniors view driving as essential to their independence and will resist giving up the car keys. For help approaching the conversation, visit the NIH National Institute on Aging website on older drivers at www.nia.nih.gov/health/older-drivers.

Financial and Legal Issues

As we age, we lose mental alertness. Due dates for bills pass, insurance policies lapse, and poor financial decisions may be made. Your elderly parent will likely need your assistance with his or her financial, legal, and medical matters.

Banking. Most banks offer automatic bill-payment services from checking or savings accounts—a convenient option if your parent is internet savvy. Or your parent can give you responsibility for his or her finances by having bills and financial statements sent to your address. You might also consider a bill-pay service, which receives a copy of invoices and then requests your parent’s bank or financial institution to send checks directly to payees.

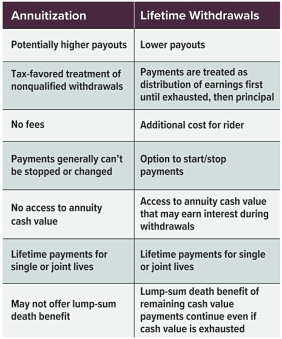

Investments and insurance. If day-to-day management of your parent’s finances is too much for you to handle, talk to your financial advisor. He or she can recommend products that provide income on a regular basis, such as managed retirement income portfolios, annuities, or bonds. Your financial advisor can also propose cash-management solutions that allow your parent’s monthly social security, retirement plan, and annuity payments to be deposited automatically into an account. You can typically access these funds through a debit card, unlimited checkwriting capabilities, and online bill-pay services—everything that a bank checking account offers.

Also, review your parent’s existing life and long-term care insurance coverage and make changes if necessary.

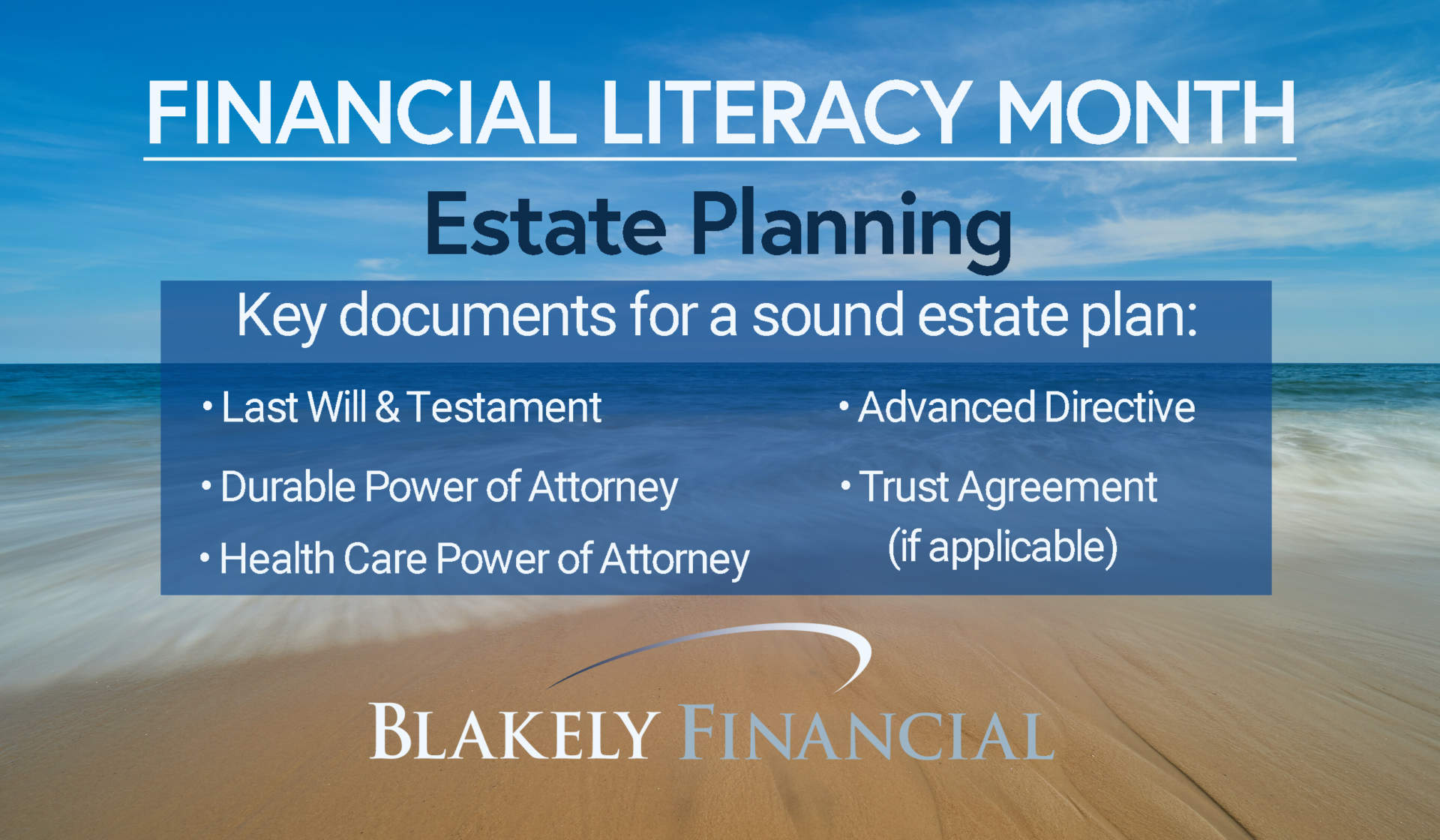

Legal concerns. An elder law attorney can help you prepare documents to manage your parent’s health care and financial affairs. In fact, many states provide free legal services to the elderly. Your parent may wish to seek an attorney’s help in the following areas:

- Appointing a health care representative. Without legal authorization from your parent, medical privacy laws prevent doctors from discussing the patient’s medical conditions with you. In addition to appointing a health care power of attorney, your parent may want to consider a living will, which provides instructions on how to manage treatment if he or she has a terminal or irreversible condition and cannot communicate.

- Understanding the process for qualifying for government programs such as Medicaid or veterans’ benefits. Don’t rely on the experiences of family or friends, as their situations may differ from your parent’s.

- Reviewing and updating estate planning documents, including his or her will, durable power of attorney, and any revocable trusts. In addition to the basic estate planning documents, your parent may wish to draft a letter outlining who will receive personal effects such as jewelry and family heirlooms.

What About Taking Care of Yourself?

Although caring for an elderly parent can feel overwhelming at times, you are not alone. Many local and national groups are available to support you in providing the care and services your parent will need. To get started, visit the U.S. Administration on Aging’s Eldercare Locator at https://eldercare.acl.gov/Public/Index.aspx or call 800.677.1116.

At your workplace, talk with a member of the human resources staff to find out if you’re eligible for unpaid leave under the Family and Medical Leave Act. Also, ask about the availability of an employee assistance program (EAP). EAPs are intended to help employees deal with personal problems—including concerns about aging parents—that might adversely impact their work performance, health, and well-being.

Finally, seek the help of a financial planner. In addition to reviewing whether your parent’s resources are sufficient to pay for care, he or she can help you determine how to balance your own goals with your parent’s needs.

Additional Online Resources

For further information on caring for an aging parent, you may find these resources helpful:

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

ROBERT BLAKELY, CFP® is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262. He is the founder and president of Blakely Financial, Inc. celebrating 25 years in business.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Prepared by Commonwealth Financial Network