Presented by ROBERT BLAKELY, CFP®, AIF®, CHFC®

Estate planning is for everyone regardless of your financial circumstances. Through an estate plan, you have a say how, when and to whom your assets are transferred, in addition to achieving your own specific tax and non-tax planning goals.

Organizing your financial affairs and planning ahead to help alleviate stress for your loved ones is an important financial planning objective. And a well-thought-out estate plan can help manage and preserve your assets during life as well as protect your loved ones by conserving and directing the distribution of assets at death. While this topic is never a pleasant one, it is imperative to any financial planning process that you might embark upon to protect you and your loved ones.

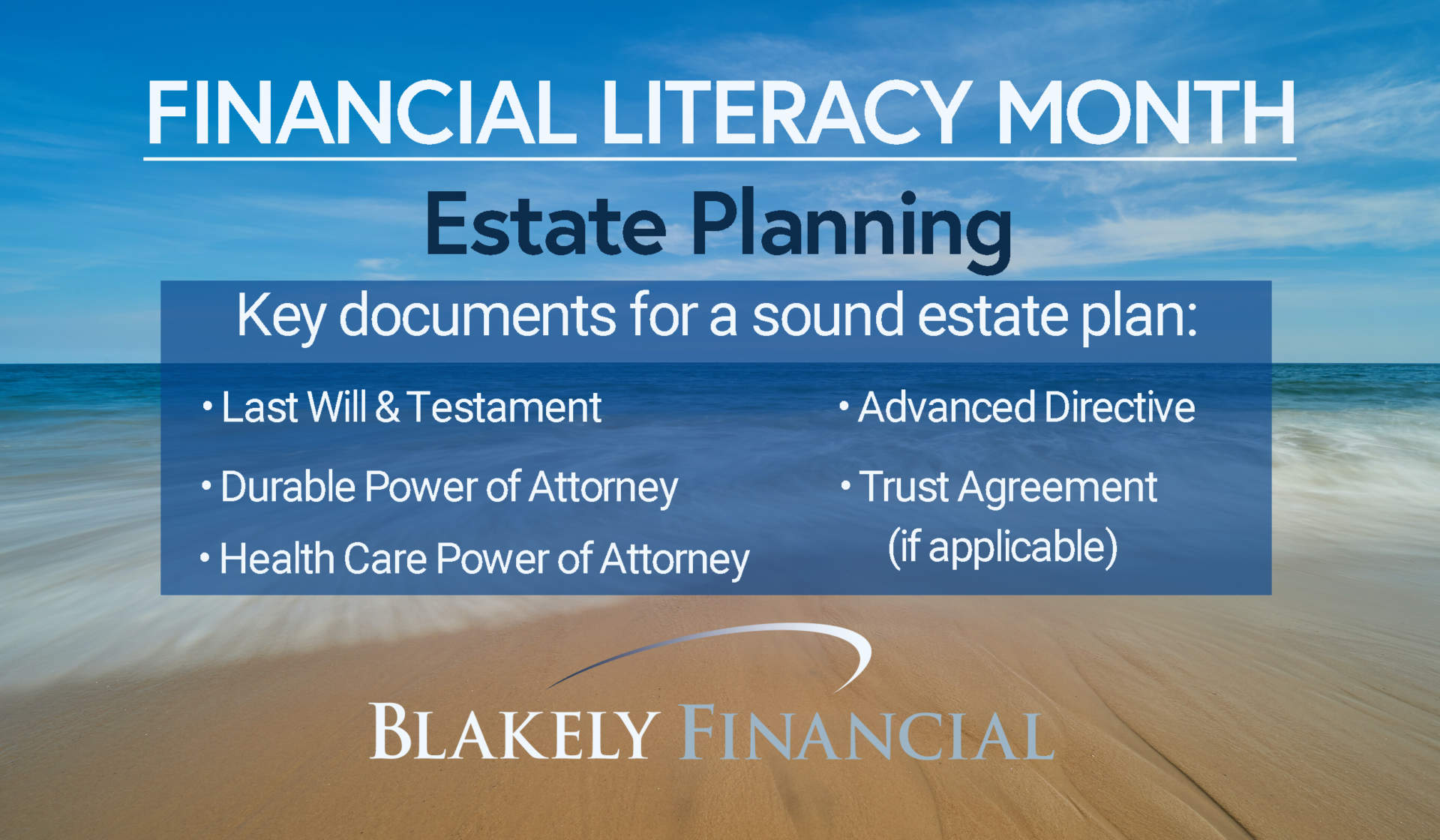

Essential Estate Planning Documents

These are some of the estate planning documents that you need regardless of your age, health or wealth.

- Durable power of attorney

- Advance Medical Directives

- Will

- Trust Agreement (dependent upon your specific situation)

Durable Power of Attorney –A durable power of attorney (DPOA) can help protect your property in the event you become physically unable or mentally incompetent to handle financial matters. If no one is ready to look after your financial affairs when you cannot, your property may be wasted, abused, or lost.

A DPOA allows you to authorize someone else to act on your behalf, so he or she can do things like pay everyday expenses, collect benefits, watch over your investments, and file taxes.

Advance Medical Directives – With a Healthcare Power of Attorney (HCPOA), you authorize an agent to handle your healthcare needs in a manner consistent with your intentions in the event of your incapacity. This includes permission for the agent to authorize actions regarding the continuation of life support, nutrition, and hydration, as well as to deal with general health care decisions that may arise.

Some states authorize a secondary health care document, typically called a living will. It works in conjunction with a Healthcare POA, authorizing your healthcare providers to take specific action in the event that there is no reasonable hope of your recovery. It also serves an important function when the agent or other individuals you named in your health care POA are unable to make a decision on your behalf relative to continuing life-sustaining treatment.

Will – A will is often said to be the cornerstone of any estate plan. The main purpose of a will is to disburse property to heirs after your death. If you do not leave a will, disbursements will be made according to state law, which might not be what you would want. When writing your will, you can name the person (executor) who will manage and settle your estate and you can name a legal guardian for minor children or dependents with special needs. If you do not appoint a guardian, the state will appoint one for you and that probably will not be within your wishes. It is crucial that your will is well-written, articulated and properly executed under your state’s laws. You must also remember to keep your will up-to-date and make changes when you experience large life events.

Trust – With a trust, you can plan for the management of assets during your life, if you become incapacitated, and upon your death. A trust can also help minimize potential federal or state estate taxes. Trusts come in two general forms: testamentary trusts, which are funded at death, and living trusts, which are funded during your lifetime. Generally revocable, a living trust is the centerpiece of a well-rounded estate plan. When a living trust is established, the process of distributing assets at the time of death will not be subject to the jurisdiction and oversight of the probate court.

Estate Planning Benefits

Spending time now to properly plan for the future includes the following benefits:

- Provides financial security for your family

- Ensures that your property will be preserved and passed on to beneficiaries

- Mitigates or avoids disputes among family members

- Minimizes estate taxes and other administrative costs

- Ensures competent management of your property in the case of incapacity

- Enables you to provide for a favorite charity

Other Considerations

A will governs only probate property; a trust governs only assets owned by the trust. In addition, some assets pass outside of probate by virtue of a beneficiary designation or the manner in which title is held. Therefore, it is important for you and your financial advisor and estate planning attorney to review the ownership and/or beneficiary designation of these assets to be sure that they will be distributed according to your wishes upon death. These assets include:

- Jointly held property

- Life insurance proceeds

- Retirement benefits

- Employee death benefits

- Retirement plan proceeds

The team at Blakely Financial is here to work with you and your estate attorney to create an estate plan that suits your needs and that helps you to achieve your financial and personal goals. If you are not a client of our firm, we encourage you to contact your financial advisor to seek guidance with your estate planning goals or contact one of our team members who would be happy to help.

Prepared by Commonwealth Financial Network

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other expert advice we can provide towards your financial well-being.

ROBERT BLAKELY, CFP® is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262. He is the founder and president of Blakely Financial, Inc. celebrating 25 years in business.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.