We are entering the halfway point in the year. Now is a great time to do a mid-year check of your goals. And a great way to do this is to start with an ‘elevator pitch’. Imagine stepping into an elevator and realizing that you are about to spend the 30-second ride with someone who could make your retirement dreams come true — if only you could explain them before the doors open again. How would you summarize your financial situation, outlook, aspirations, and plans if you had 30 seconds to make an “elevator pitch” about achieving one of your most important goals?

Answering that question — and formulating your own unique retirement dream elevator pitch — could help bring your vision of the future into sharper focus and make sure you are on the path to reaching those goals.

What Are Your Goals?

Start with an overview of what you hope to accomplish. That typically includes describing what you want, when you want it, and why. For example, you might say, “My goal involves retiring in 10 years and moving to a different state so I can be closer to family.” Or, “In the next 15 years, I need to accumulate enough money to retire from my regular job and open a part-time business that will help sustain my current lifestyle.”

If your plans include sharing life with a loved one, make sure you’re both on the same page. Rather than assume you have similar ideas about retirement, discuss what you want a future together to look like.

How Much Will It Cost?

To put a price tag on your retirement dream, consider working with a financial professional to calculate how much money you’ll need. Making multiple calculations using different variables — such as changing your anticipated retirement date and potential investment growth rate — will help you develop a better understanding of the challenges and opportunities you may encounter.

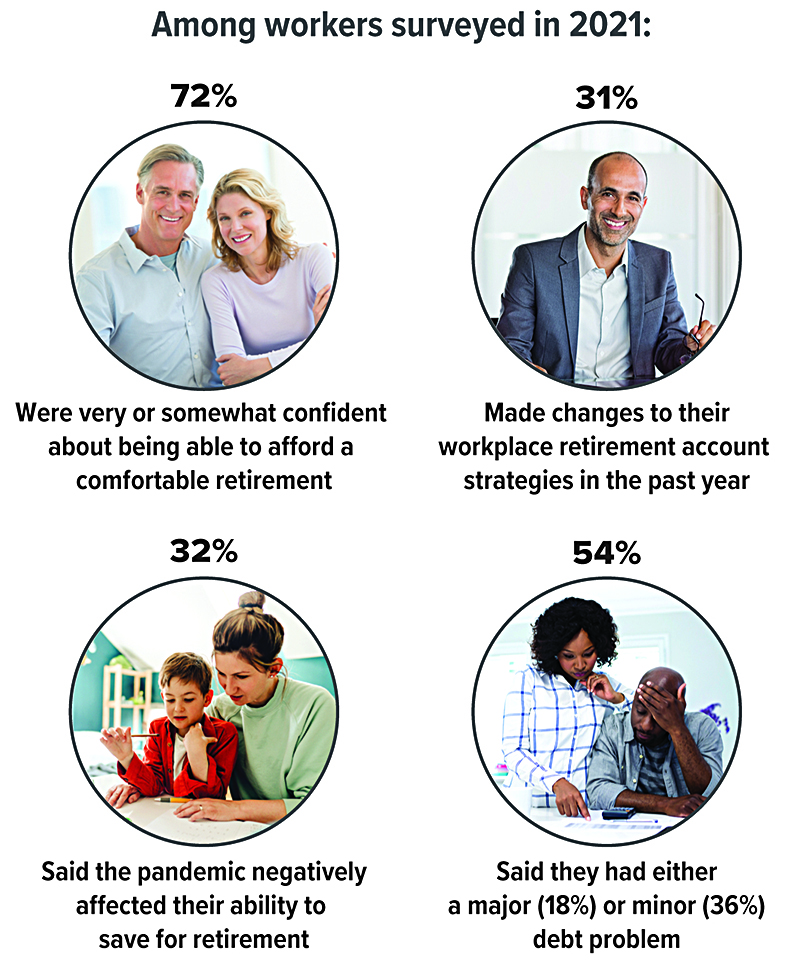

It’s important to remember that plans don’t always work out the way we intend. For example, 72% of workers surveyed in 2021 said they expect to continue working for pay during retirement, but only 30% of retirees said they actually did so. And nearly half (46%) of current retirees left the workforce earlier than expected.1 Understanding the financial implications of an unanticipated change in plans before it happens could make it easier to adjust accordingly.

How Will You Do It?

If your calculations indicate you may be facing a retirement savings shortfall, take a fresh look at your spending habits to help find ways to save more money. Make a list of your fixed expenses and then keep track of your discretionary purchases every day for a month. It might be startling to realize how much you routinely spend on non-essential items, but you’ll quickly discover exactly where to start applying more financial discipline.

Source: Employee Benefit Research Institute, 2021

Finally, you’ll need to manage the funds you earmark for retirement by choosing the types of accounts to use and allocating your money within each account. If you have access to an employer-sponsored retirement account with matching contributions from your employer, you might want to start there and then invest in additional tax-deferred and taxable investments.

Regardless of the types of accounts you choose, your specific investment decisions should reflect your personal tolerance for risk and time frame, while addressing the priorities outlined in your retirement dream elevator pitch. If your retirement outlook changes at any point, take a fresh look at your investment strategy to make sure you’re still potentially on course.

Taking time to perform this exercise of crafting your ‘elevator pitch’ and talking to your trusted financial advisor to review your goals and current situation is imperative in helping to achieve your goals and dreams.

All investing involves risk, including the possible loss of principal. There is no guarantee that any investment strategy will be successful. Asset allocation is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss. There is no assurance that working with a financial professional will improve investment results.

1) Employee Benefit Research Institute, 2021

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to ensure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at www.blakelyfinancial.com to see what other financial tips we can provide for your financial well-being.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.