As we approach year-end, now is a great time to take advantage of several end-of-the-year financial planning tips that you may have been procrastinating on. Watch now for tips from Robert Blakely, Certified Financial Planner®!

As we approach year-end, now is a great time to take advantage of several end-of-the-year financial planning tips that you may have been procrastinating on. Watch now for tips from Robert Blakely, Certified Financial Planner®!

By Emily Promise, CFP®, CDFA®, AIF®, APMA®, CRPC®

The COVID-19 economic crisis tested the mettle of all Americans, mainly working mothers. Research shows that the pandemic’s impacts on women have been far-reaching and potentially long-lasting. Now that the U.S. economy is picking up steam, it may be more important than ever for women to re-examine their retirement planning strategies.

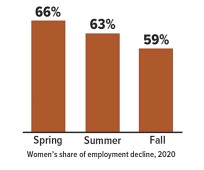

The COVID-19 recession disproportionately impacted working women because sectors that typically employ them — including retail, hospitality, and health care — were hit harder than others. As noted in a paper released by the National Bureau of Economic Research, “Employment fell more for women compared to men at every stage during the pandemic, with the biggest gender differences estimated for married women with children.” Many women were forced to cut work hours or leave jobs entirely to care for family members and supervise remote schooling activities when daycares and schools shut down.1

In a Pew Research study, 64% of women said they or someone in their household lost a job or took a pay cut during the pandemic, and nearly a quarter took unpaid time off for personal, family, or medical reasons. Half of women ranked their financial situation as “only fair” or “poor.”2

When it comes to retirement savings, unmarried women have the most ground to cover, according to an Employee Benefit Research Institute survey. Nearly six in 10 have less than $50,000 set aside for retirement; 31% have saved less than $1,000.3

Couple these statistics with the retirement planning challenges women faced even before the pandemic — longer life spans and lower earnings and Social Security benefits, on average — and it’s apparent that women need a carefully considered retirement strategy that will help them pursue their goals.

If you or a loved one need to make up lost ground, consider the following tips.

1. Save as much as possible in tax-advantaged investment vehicles, such as employer-based retirement plans and IRAs. In 2021, you can contribute up to $19,500 to 401(k) and similar plans and $6,000 to IRAs. Those figures jump to $26,000 and $7,000, respectively, if you are 50 or older. If your employer offers a match, be sure to contribute at least enough to take full advantage of it. If you have no income but you’re married and file a joint income tax return, you can still contribute to a spousal IRA in your name, provided your spouse earns at least as much as you contribute.

2. Familiarize yourself with basic investing principles: dollar-cost averaging, diversification, and asset allocation. Dollar-cost averaging involves continuous investments in securities, regardless of fluctuating prices, and can be an effective way to accumulate shares to help meet long-term goals. However, you should consider your financial ability to continue making purchases during periods of low and high price levels. (If you contribute to an employer-based plan, you’re already using dollar-cost averaging.) Diversification and asset allocation are methods to help manage investment risk while building a portfolio appropriate for your needs. Note that all investment involves risk, and none of these strategies guarantees a profit or protects against investment loss.

3. Seek guidance from your financial professional, who can provide an objective opinion during challenging times and may be able to help you find ways to reduce costs and save more. Although there is no assurance that working with a financial professional will improve investment results, a professional can evaluate your objectives and available resources and help you consider appropriate long-term financial strategies.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other specialized advice we can provide towards your financial well-being.

EMILY PROMISE is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262 and can be reached at (336) 885-2530.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Prepared by Commonwealth Financial Network®

Presented by STEPHEN LAFRANCE, CFP®, MBA

During the 12 months ending in June 2021, consumer prices shot up 5.4%, the highest inflation rate since 2008.1 The annual increase in the Consumer Price Index for All Urban Consumers (CPI-U) — often called headline inflation — was due in part to the “base effect.” This statistical term means the 12-month comparison was based on an unusually low point for prices in the second quarter of 2020 when consumer demand and inflation dropped after the onset of the pandemic.

However, some evident inflationary pressures entered the picture in the first half of 2021. As vaccination rates climbed, pent-up consumer demand for goods and services was unleashed, fueled by stimulus payments and healthy savings accounts built by those with little opportunity to spend their earnings. Many businesses that shut down or cut back when the economy closed could not quickly ramp up enough to meet surging demand. Supply-chain bottlenecks, along with higher costs for raw materials, fuel, and labor, resulted in some troubling price spikes.2

CPI-U measures the price of a fixed market basket of goods and services. It is a good measure of consumers’ costs if they buy the same items over time, but it does not reflect changes in consumer behavior. Extreme increases can unduly influence it in one or more categories. In June 2021, for example, used-car prices increased 10.5% from the previous month and 45.2% year-over-year, accounting for more than one-third of the increase in CPI. Core CPI, which strips out volatile food and energy prices, rose 4.5% year-over-year.3

The Federal Reserve prefers a different inflation measure called the Personal Consumption Expenditures (PCE) Price Index in setting economic policy. This measure is even broader than the CPI and adjusts for changes in consumer behavior — i.e., when consumers shift to purchase a different item because the preferred thing is too expensive. More specifically, the Fed looks at core PCE, which rose 3.5% through the 12 months ending in June 2021.4

The perspective held by many economic policymakers, including Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen, was that the spring rise in inflation was due primarily to base effects. As such, temporary supply-and-demand mismatches, so the impact would be mostly “transitory.”5 Regardless, some prices won’t fall back to their former levels once they have risen, and even short-lived bursts of inflation can be painful for consumers.

Some economists fear that inflation may last longer, with more severe consequences, and could become difficult to control. This camp believes that loose monetary policies by the central bank and trillions of dollars in government stimulus have pumped an excess supply of money into the economy. In this scenario, a booming economy and persistent and/or substantial inflation could result in a self-reinforcing feedback loop in which businesses, faced with less competition and expecting higher costs in the future, raise their prices preemptively, prompting workers to demand higher wages.6

Until recently, inflation had consistently lagged the Fed’s 2% target, which it considers a healthy rate for a growing economy, for more than a decade. In August 2020, the Federal Open Market Committee (FOMC) announced that it would allow inflation to rise moderately above 2% for some time to create a 2% average rate over the longer term. This signaled that economists anticipated short-term price swings and assured investors that Fed officials would not overreact by raising interest rates before the economy had fully healed.7

In mid-June 2021, the FOMC projected core PCE inflation to be 3.0% in 2021 and 2.1% in 2022. The benchmark federal funds range was expected to remain at 0.0% to 0.25% until 2023.8 However, Fed officials have also said they are watching the data closely and could raise interest rates sooner, if needed, to cool the economy and curb inflation.

Projections are based on current conditions, are subject to change, and may not come to pass.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

STEPHEN LAFRANCE, CFP®, MBA is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262. 336-885-2530.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

In 2020, 31% of U.S. workers with employer-sponsored health insurance had a high-deductible health plan (HDHP), up from 24% in 2015.1 These plans are also available outside the workplace through private insurers and the Health Insurance Marketplace.

The average annual employee premium for HDHP family coverage in 2020 was $4,852 versus $6,017 for a PPO, a savings of $1,165 per year.3 In addition, many employers contribute to a health savings account (HSA) for the employee, and contributions by the employer or the employee are tax-advantaged (see below). Taken together, these features could add up to substantial savings that can be used to pay for current and future medical expenses.

You pay more out of pocket for medical services with an HDHP until you reach the annual deductible in return for lower premiums.

Deductible: An HDHP has a higher deductible than a PPO. Still, PPO deductibles have been rising, so consider the difference between plan deductibles and whether the deductible is per person or family. PPOs may have a separate deductible (or no deductible) for prescription drugs, but the HDHP deductible will apply to all covered medical spending.

Copays: PPOs typically have copays that allow you to obtain certain services and prescription drugs with a defined payment before meeting your deductible. With an HDHP, you pay out of pocket until you meet your deductible, but the insurer’s negotiated rate may reduce costs. For example, consider the difference between the copay and the negotiated rate for a standard service such as a doctor visit – certain types of preventive care and preventive medicines may be provided at no cost under both types of plans.

Maximums: Most health insurance plans have annual and lifetime out-of-pocket maximums above which the insurer pays all medical expenses. HDHP maximums may be the same or similar to that of PPO plans. (Some PPO plans have a separate annual maximum for prescription drugs.) If you have high medical costs that exceed the yearly maximum, your total out-of-pocket costs for that year would typically be lower for an HDHP with the savings on premiums.

Both PPOs and HDHPs offer incentives to use healthcare providers within a network, and the network may be identical if the same insurance company provides the plans. Make sure your preferred doctors are included in the network before enrolling.

Also, consider whether you are comfortable using the HDHP structure. Although it may save money over a year, you might be hesitant to obtain appropriate care because of the higher out-of-pocket expense at the time of service.

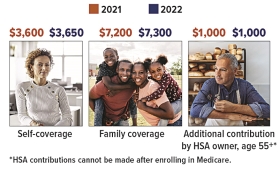

High-deductible health plans are designed to be paired with a tax-advantaged health savings account (HSA) that can be used to pay medical expenses incurred after the HSA is established. HSA contributions are typically made through pre-tax payroll deductions, but in most cases, they can also be made as tax-deductible contributions directly to the HSA provider. HSA funds, including any earnings if the account has an investment option, can be withdrawn free of federal income tax and penalties as long as the money is spent on qualified healthcare expenses. (Some states do not follow federal tax rules on HSAs.)

The assets in an HSA can be retained in the account or rolled over to a new HSA if you change employers or retire. In addition, unspent HSA balances can be used to pay future medical expenses whether you are enrolled in an HDHP or not; however, you must be enrolled in an HDHP to establish and contribute to an HSA.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other expert advice we can provide towards your financial well-being.

ROBERT BLAKELY, CFP® is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262. He is the founder and president of Blakely Financial, Inc.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Diversification and asset allocation programs do not assure a profit or protect against loss in declining markets, and cannot guarantee that any objective or goal will be achieved.

Whether you’ve been saving and planning for your child’s college education for the past 18 years or you just recently started discussing college plans with your child, senior year is the time when many decisions need to be made.

The summer before your child’s senior year is a good time to narrow down college choices. If you haven’t done so already, now is the time to research colleges online, request catalogs, attend college fairs, and visit campuses to help finalize the list of schools.

Be sure to note specific school deadlines for applications, scholarships, and financial aid forms and check them regularly. The following calendar is a general overview of the application and financial aid process.

| Fall | Winter | Spring | Summer |

| Research colleges online, attend college fairs, and visit college campuses to make a final list | General admission applications are typically due in December or January—confirm the deadline for each school | Review financial aid packages offered by various colleges; compare out-of-pocket costs at each college | Buy school and dorm supplies |

| Early decision/early action applications are typically due in October or November—confirm the deadline for each school | Submit college PROFILE financial aid form and college-specific financial aid forms where necessary | Review ongoing requirements of any college scholarships if selected | Work to earn spending money |

| Attend financial aid night at local high school | Confirm that colleges have received all application and financial aid materials | Make a final decision and notify the college by May 1 | Prepare to move if you are going away to school |

| The federal government’s financial aid application, the FAFSA, can be filed as early as October 1 | Continue to apply for college scholarships | Pay required college deposit | Sign student loan promissory note and receive federal student loan counseling if applicable |

| Apply for college-specific scholarships | Research and apply for private scholarships | Sign up for college orientation session if required | Off to college! |

| An independent third party has developed this resource.

Commonwealth Financial Network is not responsible for their content and does not guarantee their accuracy or completeness, and they should not be relied upon as such. These materials are general in nature and do not address your specific situation. For your specific investment needs, please discuss your individual circumstances with your representative. Commonwealth does not provide tax or legal advice, and nothing in the accompanying pages should be construed as specific tax or legal advice. Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser. Fixed insurance products and services offered through Blakely Financial or CES Insurance Agency

This communication is strictly intended for individuals residing in the state(s) of AK, AZ, AR, CA, CO, FL, GA, IL, IA, MA, MD, MI, MN, MS, MO, NJ, NY, NC, OK, PA, SC, SD, TN, TX, VA, WV, and WI. No offers may be made or accepted from any resident outside the specific states referenced. |

|

| Prepared by Broadridge Advisor Solutions Copyright 2021. |

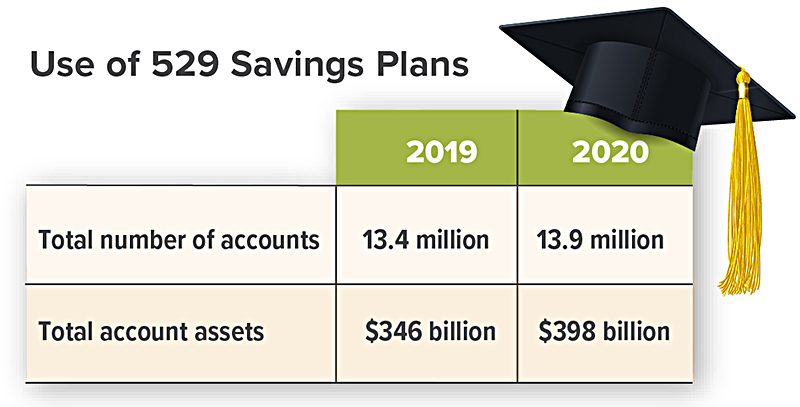

529 plans are a favored way to save for college due to the tax benefits and other advantages they offer when funds are used to pay a beneficiary’s qualified college expenses. However, up until now, the FAFSA (Free Application for Federal Student Aid) treated grandparent-owned 529 plans more harshly than parent-owned 529 plans. This will change thanks to the FAFSA Simplification Act that was enacted in December 2020. The new law streamlines the FAFSA and changes the formula used to calculate financial aid eligibility.

Under current rules, parent-owned 529 plans are listed on the FAFSA as a parent asset. Parent assets are counted at a rate of 5.64%, which means 5.64% of the value of the 529 account is deemed available to pay for college. Later, when distributions are made to pay college expenses, the funds aren’t counted; the FAFSA ignores distributions from a parent 529 plan.

By contrast, grandparent-owned 529 plans do not need to be listed as an asset on the FAFSA. This sounds like a benefit. However, the catch is that any withdrawals from a grandparent-owned 529 plan are counted as untaxed student income and assessed at 50% in the following year. This can have a negative impact on federal financial aid eligibility.

Example: Ben is the beneficiary of two 529 plans: a parent-owned 529 plan with a value of $25,000 and a grandparent-owned 529 plan worth $50,000. In Year 1, Ben’s parents file the FAFSA. They must list their 529 account as a parent asset but do not need to list the grandparent 529 account. The FAFSA formula counts $1,410 of the parent 529 account as available for college costs ($25,000 x 5.64%). Ben’s parents then withdraw $10,000 from their account, and Ben’s grandparents withdraw $10,000 from their account to pay college costs in Year 1.

In Year 2, Ben’s parents file a renewal FAFSA. Again, they must list their 529 account as a parent asset. Let’s assume the value is now $15,000, so the formula will count $846 as available for college costs ($15,000 x 5.64%). In addition, Ben’s parents must also list the $10,000 distribution from the grandparent 529 account as untaxed student income, and the formula will count $5,000 as available for college costs ($10,000 x 50%). In general, the higher Ben’s available resources, the less financial need he is deemed to have.

Under the new FAFSA rules, grandparent-owned 529 plans still do not need to be listed as an asset, and distributions will no longer be counted as untaxed student income. In addition, the new FAFSA will no longer include a question asking about cash gifts from grandparents. This means that grandparents will be able to help with their grandchild’s college expenses (either with a 529 plan or with other funds) with no negative implications for federal financial aid.

However, there’s a caveat: Grandparent-owned 529 plans and cash gifts will likely continue to be counted by the CSS Profile, an additional aid form typically used by private colleges when distributing their own institutional aid. Even then, it’s not one-size-fits-all — individual colleges can personalize the CSS Profile with their own questions, so the way they treat grandparent 529 plans can differ.

The new, simplified FAFSA opens on October 1, 2022, and will take effect for the 2023-2024 school year. However, grandparents can start taking advantage of the new 529 plan rules in 2021. That’s because 2021 is the “base year” for income purposes for the 2023-2024 FAFSA, and under the new FAFSA, a student’s income will consist only of data reported on the student’s federal income tax return. Because any distributions taken in 2021 from a grandparent 529 account won’t be reported on the student’s 2021 tax return, they won’t need to be reported as student income on the 2023-2024 FAFSA.

Consider the investment objectives, risks, charges, and expenses associated with 529 plans before investing. This information and more is available in the plan’s official statement and applicable prospectuses, including details about investment options, underlying investments, and the investment company; read it carefully before investing. Also, consider whether your state offers a 529 plan that provides residents with favorable state tax benefits and other benefits, such as financial aid, scholarship funds, and protection from creditors. As with other investments, there are generally fees and expenses associated with participation in a 529 plan. There is also the risk that the investments may lose money or not perform well enough to cover college costs as anticipated. In addition, for withdrawals not used for higher-education expenses, earnings may be subject to taxation as ordinary income and a 10% federal income tax penalty.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other specialized advice we can provide towards your financial well-being.

BLAKELY FINANCIAL, INC. is located at 1022 Hutton Ln., Suite 109, High Point, NC 27262, and can be reached at (336) 885-2530.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

| Commonwealth Financial Network is not responsible for their content and does not guarantee their accuracy or completeness, and they should not be relied upon as such. These materials are general in nature and do not address your specific situation. For your specific investment needs, please discuss your individual circumstances with your representative. Commonwealth does not provide tax or legal advice, and nothing in the accompanying pages should be construed as specific tax or legal advice. Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser. Fixed insurance products and services offered through Blakely Financial or CES Insurance Agency

This communication is strictly intended for individuals residing in the state(s) of AK, AZ, AR, CA, CO, FL, GA, IL, IA, MD, MI, MN, MS, MO, NJ, NY, NC, OK, PA, SC, SD, TN, TX, VA, WV, and WI. No offers may be made or accepted from any resident outside the specific states referenced. |

|

| Prepared by Broadridge Advisor Solutions Copyright 2021. |

College is expensive! Not just tuition, but all of the costs incurred with daily living for students. How are you preparing your children for lifelong financial success through their college experience? Keep watching for tips from Emily Promise on how to best help your college-aged children learn the importance of investing and budgeting!

Presented by Emily Promise

How does a millionaire woman look? Well, millionaires – women and men – come in all shapes and sizes.

First, we will look at the profile of a millionaire woman. Here are some basic facts:

Millionaire women and women, in general, all share the following traits:

All millionaire women have a plan. Women, in general, love the idea of a financial plan – it serves as a road map to reach their goals, whatever those may be.

Women take on myriad roles in life and, to coordinate everything, planning is a vital component! (Think about trekking the kids around to all their extra activities without a schedule or forethought!)

When it comes to finances, it takes diligent savings to amaze the wealth that women have. As they say, money does not grow on trees.

One final trait that all millionaire women share is that they want their concerns addressed. Whether it’s the financial concern of having enough money, or the personal, such as how will I care for my aging parents, women want someone to go to as a trusted advisor to provide clarity, insight, and guidance to elevate their concerns.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other specialized advice we can provide towards your financial well-being.

EMILY PROMISE is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262 and can be reached at (336) 885-2530.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Prepared by Commonwealth Financial Network®

Presented by Robert C. Blakely

Designating a beneficiary on retirement accounts is one of the most important—yet one of the most frequently neglected—retirement and financial planning tasks. Oftentimes people forget to update beneficiaries after major life events. A beneficiary is any person or entity that an account owner chooses to receive the benefits of a retirement account in the event the account owner dies.

Here are some important factors to consider when selecting beneficiaries for your retirement accounts:

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other expert advice we can provide towards your financial well-being.

ROBERT BLAKELY, CFP® is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262. He is the founder and president of Blakely Financial, Inc.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Diversification and asset allocation programs do not assure a profit or protect against loss in declining markets, and cannot guarantee that any objective or goal will be achieved.