Presented by STEPHEN LAFRANCE, CFP®, MBA

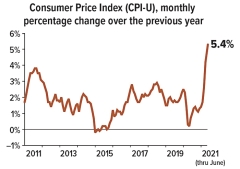

During the 12 months ending in June 2021, consumer prices shot up 5.4%, the highest inflation rate since 2008.1 The annual increase in the Consumer Price Index for All Urban Consumers (CPI-U) — often called headline inflation — was due in part to the “base effect.” This statistical term means the 12-month comparison was based on an unusually low point for prices in the second quarter of 2020 when consumer demand and inflation dropped after the onset of the pandemic.

However, some evident inflationary pressures entered the picture in the first half of 2021. As vaccination rates climbed, pent-up consumer demand for goods and services was unleashed, fueled by stimulus payments and healthy savings accounts built by those with little opportunity to spend their earnings. Many businesses that shut down or cut back when the economy closed could not quickly ramp up enough to meet surging demand. Supply-chain bottlenecks, along with higher costs for raw materials, fuel, and labor, resulted in some troubling price spikes.2

Monitoring Inflation

CPI-U measures the price of a fixed market basket of goods and services. It is a good measure of consumers’ costs if they buy the same items over time, but it does not reflect changes in consumer behavior. Extreme increases can unduly influence it in one or more categories. In June 2021, for example, used-car prices increased 10.5% from the previous month and 45.2% year-over-year, accounting for more than one-third of the increase in CPI. Core CPI, which strips out volatile food and energy prices, rose 4.5% year-over-year.3

The Federal Reserve prefers a different inflation measure called the Personal Consumption Expenditures (PCE) Price Index in setting economic policy. This measure is even broader than the CPI and adjusts for changes in consumer behavior — i.e., when consumers shift to purchase a different item because the preferred thing is too expensive. More specifically, the Fed looks at core PCE, which rose 3.5% through the 12 months ending in June 2021.4

Competing Viewpoints

The perspective held by many economic policymakers, including Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen, was that the spring rise in inflation was due primarily to base effects. As such, temporary supply-and-demand mismatches, so the impact would be mostly “transitory.”5 Regardless, some prices won’t fall back to their former levels once they have risen, and even short-lived bursts of inflation can be painful for consumers.

Some economists fear that inflation may last longer, with more severe consequences, and could become difficult to control. This camp believes that loose monetary policies by the central bank and trillions of dollars in government stimulus have pumped an excess supply of money into the economy. In this scenario, a booming economy and persistent and/or substantial inflation could result in a self-reinforcing feedback loop in which businesses, faced with less competition and expecting higher costs in the future, raise their prices preemptively, prompting workers to demand higher wages.6

Until recently, inflation had consistently lagged the Fed’s 2% target, which it considers a healthy rate for a growing economy, for more than a decade. In August 2020, the Federal Open Market Committee (FOMC) announced that it would allow inflation to rise moderately above 2% for some time to create a 2% average rate over the longer term. This signaled that economists anticipated short-term price swings and assured investors that Fed officials would not overreact by raising interest rates before the economy had fully healed.7

In mid-June 2021, the FOMC projected core PCE inflation to be 3.0% in 2021 and 2.1% in 2022. The benchmark federal funds range was expected to remain at 0.0% to 0.25% until 2023.8 However, Fed officials have also said they are watching the data closely and could raise interest rates sooner, if needed, to cool the economy and curb inflation.

Projections are based on current conditions, are subject to change, and may not come to pass.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

STEPHEN LAFRANCE, CFP®, MBA is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262. 336-885-2530.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.