Category: Financial Planning

When Two Goals Collide: Balancing College and Retirement Preparations

You’ve been doing the right thing financially for many years, saving for your child’s education and your retirement. Yet now, as both goals loom in the years ahead, you may wonder what else you can do to help your child (or children) receive a quality education without compromising your own retirement goals.

Knowledge Is Power

Start by reviewing the financial aid process and understanding how financial need is calculated. Colleges and the federal government use different formulas to determine need by looking at a family’s income (the most crucial factor), assets, and other household information.

A few key points:

- Generally, the federal government assesses up to 47% of parent income (adjusted gross income plus untaxed income/benefits minus certain deductions) and 50% of a student’s income over a certain amount. Parent assets are counted at 5.6%; student assets are calculated at 20%.1

- Certain parent assets are excluded, including home equity and retirement assets.

- The Free Application for Federal Student Aid (FAFSA) relies on your income from two years prior (the “base year”) and current assets for its analysis. For example, for the 2023-2024 school year, the FAFSA will consider your 2021 income tax record and your assets at the time of application.

Strategies to Consider

Financial aid takes two forms: need-based aid and merit-based aid. Although middle- and higher-income families typically have a more challenging time receiving need-based aid, there are some ways to reposition your finances to potentially enhance eligibility:

- Time the receipt of discretionary income to avoid the base year.

- Have your child limit their income during the base year to the excludable amount.

- Use countable assets (such as cash savings) to increase investments in your college and retirement savings accounts and pay down consumer debt and your mortgage.

- Make a significant purchase, such as a car or home improvement, to reduce liquid assets.

Many colleges use merit-aid packages to attract students, regardless of financial need. As your family explores colleges in the years ahead, be sure to investigate merit-aid opportunities as well. A net price calculator, available on every college website, can give you an estimate of how much financial aid (merit- and need-based) your child might receive at a particular college.

Don’t Lose Sight of Retirement

What if you’ve done all you can and still face a sizable gap between how much college will cost and how much you have saved? To help your child graduate with as little debt as possible, you might consider borrowing or withdrawing funds from your retirement savings. Though tempting, this is not an ideal move. While your child can borrow to finance their education, you generally cannot take a loan to fund your retirement. If you make retirement savings and debt reduction (including a mortgage) a priority now, you may be better positioned to help your child repay any loans later.

Some Parents Use Retirement Funds to Pay for College

Source: Sallie Mae, 2021

Consider speaking with a financial professional about how these strategies may help you balance these two challenging and important goals. Of course, there is no assurance that working with a financial professional will improve investment results.

Withdrawals from traditional IRAs and most employer-sponsored retirement plans are taxed as ordinary income. They may be subject to a 10% penalty tax if taken before age 59½ unless an exception applies. (IRA withdrawals used for qualified higher-education purposes avoid the early-withdrawal penalty.)

1) College Savings Plan Network, 2021

Building Blocks for Financing College with Less Debt

Financing a college education with the least debt involves putting together various resources in the most favorable way for your family. It requires planning, savings discipline, an understanding of financial aid, innovative college research, and good decision making at college time.

Your College Fund

Your savings are the cornerstone of any successful college financing plan. It’s helpful to think of your college savings as a down payment on the total cost, similar to a down payment on a home. Then, you can supplement your savings with other available resources at college time.

Setting aside money for college over many years takes discipline, and in many cases, sacrifice, including lifestyle changes. Of course, every family’s situation is different. But if you save regularly over time, you might be surprised at how much you could accumulate in your college fund.

Financial Aid

Financial aid is the next piece of the puzzle. It’s a broad term that can mean many things, with concepts that are often used interchangeably. At its core, financial aid is money to help pay for college: loans, grants, scholarships, and work-study. Your overall goal is to get the most grants and scholarships (grant aid) and the least amount of loans.

Colleges are the largest source of grant aid, with annual need-based and merit-based grant awards that can be in the tens of thousands of dollars. By contrast, the federal government’s two central grants, the Pell Grant and the Supplemental Educational Opportunity Grant, are generally smaller and reserved for students with the greatest financial need.

To help find colleges with the most generous grant aid, use a net price calculator available on every college website. A net price calculator estimates how much grant aid a student might expect based on their financial information and academic profile. By completing a net price calculator for several colleges, you can compare what your out-of-pocket cost (net price) might be at different schools and rank colleges based on affordability.

The federal government’s main contribution to the world of financial aid is student loans. Regardless of financial need, all students are eligible for federal student loans.

Additional Funding Sources

Other potential resources at college time might help reduce the overall amount you’ll need to borrow: what you can contribute from current income during the college years; your child’s earnings from a school or summer job; education tax credits, which could be worth up to $2,500 per year; financial help from grandparents or other relatives; and scholarships from civic, private, or nonprofit groups.

On the cost-cutting side, your child might consider graduating in less than four years; attending community college for two years and then transferring to a four-year college; becoming a resident assistant to get free or discounted room and board; living at home for a semester or two; exploring all in-state public college options, and deferring enrollment for a year to earn money and take advantage of any employer educational assistance.

After taking everything into account — the amount of your college fund, the grant aid your child might receive at specific colleges, the amount of money you and your child can contribute from current income during the college years, and the availability of other resources and cost-cutting measures — you can determine how much borrowing would be required for specific colleges and make an informed choice.

Borrowing money to pay for college can quickly spiral out of control. Make sure your child understands the monthly payment for different loan amounts over a 10-year repayment term. If the numbers look daunting, don’t be afraid to say “no” to specific colleges. Unfortunately, most teenagers experienced in finance enough to understand the negative consequences of excessive borrowing fully, so it’s up to parents to help eliminate options that aren’t economically viable.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to ensure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

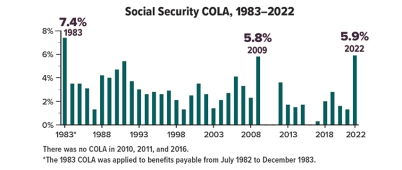

Big Boost for Social Security Payments

The Social Security cost-of-living adjustment (COLA) for 2022 is 5.9%, the most significant increase since 1983. The COLA applies to December 2021 benefits, payable in January 2022. The amount is based on the rise in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from Q3 of the last year a COLA was determined to Q3 of the current year (in this case, Q3 2020 to Q3 2021).

Despite these annual adjustments for inflation, a recent study found that the buying power of Social Security benefits declined by 30% from 2000 to early 2021, in part because the CPI-W is weighted more heavily toward items purchased by younger workers than by Social Security beneficiaries.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to ensure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Holiday Conversation Topics

The holidays are a time for gathering with family and friends. As we return to in-person gatherings this holiday season, there will be countless opportunities for meaningful conversations with your family. There are so many important financial planning topics that can and should be discussed. I’m here to share some topics of conversation to have across all generations of the family.

The Patriarchs & Matriarchs (“Grandparents”) of the family to their grown adult children:

Who will help with medical and end-of-life decisions? Do they know where your financial accounts are? Discuss your estate planning wishes with your adult children; share where to locate vital documents (password books, estate documents).

Adults to their Children:

For Young Children – Talk about the importance of saving and giving back to the community in which you live (holidays are about more than just gifts – teach them this lesson while they are young!)

Teenaged Children – What are their goals for the future? Are they considering going to college? Are they working on making varsity on a sports team next season? Listen to them, hear them out, and then share with them knowledge and lessons you have learned in the past.

Young Adult Children – At this period in their life, they have a lot going on – new jobs, maybe a home purchase, starting families of their own – all major life decisions! Discuss the importance of looking into the future and planning for such goals.

Now, once you work through the serious stuff – and the holiday punch has kicked in – here are some fun, thought-provoking conversations to have as a group:

• Start a family book club

• Share family recipes

• Plan a family reunion

Make the most of the holidays and your time together. Life gets busy, and we often don’t have quality time with family, so take advantage of your time with family and friends – don’t wish it away!

401(k) and IRA: A Combined Savings Strategy

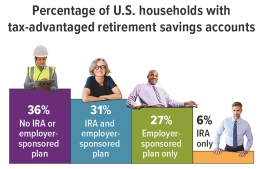

Contributing to an employer-sponsored retirement plan or an IRA is a big step on the road to retirement, but contributing to both can significantly boost your retirement assets. A recent study found that, on average, individuals who owned both a 401(k) and an IRA at some point during the six years of the survey had combined balances about 2.5 times higher than those who owned only a 401(k) or an IRA. And people who owned both types of accounts consistently over the period had even higher balances.1

Here is how the two types of plans can work together in your retirement savings strategy.

Convenience vs. Control

Employer-sponsored plans such as 401(k), 403(b), and 457(b) plans offer a convenient way to save through pre-tax salary deferrals, and contribution limits are high: $19,500 in 2021 ($20,500 in 2022) and an additional $6,500 if age 50 or older. Although the costs for investments offered in the plan may be lower than those provided in an IRA, these plans typically offer limited investment choices and have restrictions on control over the account.

IRA contribution limits are much lower: $6,000 in 2021 and 2022 ($7,000 if age 50 or older). But you can usually choose from a wide variety of investments, and the account is yours to control and keep regardless of your employment situation. For example, if you leave your job, you can roll assets in your employer plan into your IRA.2. In contrast, contributions to an employer plan generally must be made by December 31; you can contribute to an IRA up to the April tax filing deadline.

Matching and Diversification

Many employer plans match a percentage of your contributions. If your employer offers this program, it would be wise to contribute enough to receive the entire match. Of course, contributing more would be better, but you also might consider funding your IRA, especially if the contributions are deductible (see below).

Along with the flexibility and control offered by the IRA, holding assets in both types of accounts, with different underlying investments, could help diversify your portfolio. Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss.

Rules and Limits

Although annual contribution limits for employer plans and IRAs are separate, your ability to deduct traditional IRA contributions phases out at higher income levels if you are covered by a workplace plan: modified adjusted gross income (MAGI) of $66,000 to $76,000 for single filers and $105,000 to $125,000 for joint filers in 2021 ($68,000 to $78,000 and $109,000 to $129,000 in 2022).3 You can make nondeductible contributions to a traditional IRA regardless of income.

Eligibility to contribute to a Roth IRA phases out at higher income levels regardless of coverage by a workplace plan: MAGI of $125,000 to $140,000 for single filers and $198,000 to $208,000 for joint filers in 2021 ($129,000 to $144,000 and $204,000 to $214,000 in 2022).

Source: Investment Company Institute, 2021

Contributions to employer-sponsored plans and traditional IRAs are generally made pre-tax or tax-deductible and accumulate tax-deferred. Distributions are taxed as ordinary income and may be subject to a 10% federal income tax penalty if withdrawn before age 59½ (with certain exceptions). Nondeductible contributions to a traditional IRA are not taxable when withdrawn, but any earnings are subject to ordinary income tax. Required minimum distributions (RMDs) from employer-sponsored plans and traditional IRAs must begin for the year you reach age 72 (70½ if you were born before July 1, 1949). However, you are generally not required to take distributions from an employer plan as long as you still work for that employer.

Roth IRA contributions are not deductible, but they can be withdrawn at any time without penalty or taxes. To qualify for the tax-free and penalty-free withdrawal of earnings, Roth IRA distributions must meet a five-year holding requirement and take place after age 59½ (with certain exceptions). Original owners of Roth IRAs are exempt from RMDs. However, beneficiaries of all IRAs and employer plans must take RMDs based on their age and relationship to the original owner.

1) Employee Benefit Research Institute, 2020

2) Other options when separating from an employer include leaving the assets in your former employer’s plan (if allowed), rolling them into a new employer’s plan, or cashing out (usually not wise).

3) If a workplace plan does not cover you, but your spouse is covered, eligibility phases out at MAGI of $198,000 to $208,000 for joint filers in 2021 ($204,000 to $214,000 in 2022).

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to ensure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Charitable Giving Can Be a Family Affair

Charitable Giving Can Be a Family Affair

As families grow in size and overall wealth, a desire to “give back” often becomes a priority. Cultivating philanthropic values can help foster responsibility and a sense of purpose among young and old alike while providing financial benefits. In addition, charitable donations may be eligible for income tax deductions (if you itemize) and can help reduce capital gains and estate taxes. Here are four ways to incorporate charitable giving into your family’s overall financial plan.

Annual Family Giving

The holidays present a perfect opportunity to help family members develop a giving mindset. To establish an annual family giving plan, first determine the total amount that you’d like to donate as a family to charity. Next, encourage all family members to research and make a case for their favorite nonprofit organization, or divide the total amount equally among your family members and have each person donate to their favorite cause.

When choosing a charity, consider how efficiently the contribution dollars are used — i.e., how much of the organization’s total annual budget directly supports programs and services versus overhead, administration, and marketing. For help in evaluating charities, visit the Charity Navigator website, charitynavigator.org, where you’ll find star ratings and more detailed financial and operational information.

Snapshot of 2020 Giving

Despite the pandemic and economic downturn, 2020 was the highest year for charitable giving on record, reaching $471.44 billion. Giving to public-society benefit organizations, environmental and animal organizations, and human services organizations grew the most while giving to arts, culture, and humanities and health organizations declined.

Source: Giving USA 2021

Estate Planning

Charitable giving can also play a vital role in an estate plan by helping to ensure that your philanthropic wishes are carried out and potentially reducing your estate tax burden.

The federal government taxes wealth transfers both during your lifetime and at death. In 2021, the federal gift and estate tax is imposed on lifetime transfers exceeding $11,700,000, at a top rate of 40%. States may also impose taxes but at much lower thresholds than the federal government.

Ways to incorporate charitable giving into your estate plan include will and trust bequests; beneficiary designations for insurance policies and retirement plan accounts; and charitable lead and charitable remainder trusts. (Trusts incur upfront costs and often have ongoing administrative fees. The use of trusts involves complex tax rules and regulations. Before implementing such strategies, you should consider the counsel of an experienced estate planning professional and your legal and tax professionals.)

Donor-Advised Funds

Donor-advised funds offer a way to receive tax benefits now and make charitable gifts later. A donor-advised fund is an agreement between a donor and a host organization (the fund). Your contributions are generally tax-deductible, but the organization becomes the legal owner of the assets. You (or a designee, such as a family member) then advise on how those contributions will be invested and how grants will be distributed. (Although the fund has ultimate control over the assets, the donor’s wishes are generally honored.)

Family Foundations

Private family foundations are similar to donor-advised funds but on a more complex scale. Although you don’t necessarily need the coffers of Melinda Gates or Sam Walton to establish and maintain one, a private family foundation may be most appropriate if you have a significant level of wealth. The primary benefit (in addition to potential tax savings) is that you and your family have complete discretion over how the money is invested and which charities will receive grants. A drawback is that these separate legal entities are subject to stringent regulations.

These are just a few ways families can nurture a philanthropic legacy while benefitting their financial situation. For more information, contact your financial professional or an estate planning attorney.

Remember that not all charitable organizations can use all possible gifts, so it is prudent to check first; the type of organization you select can also affect the tax benefits you receive.

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.

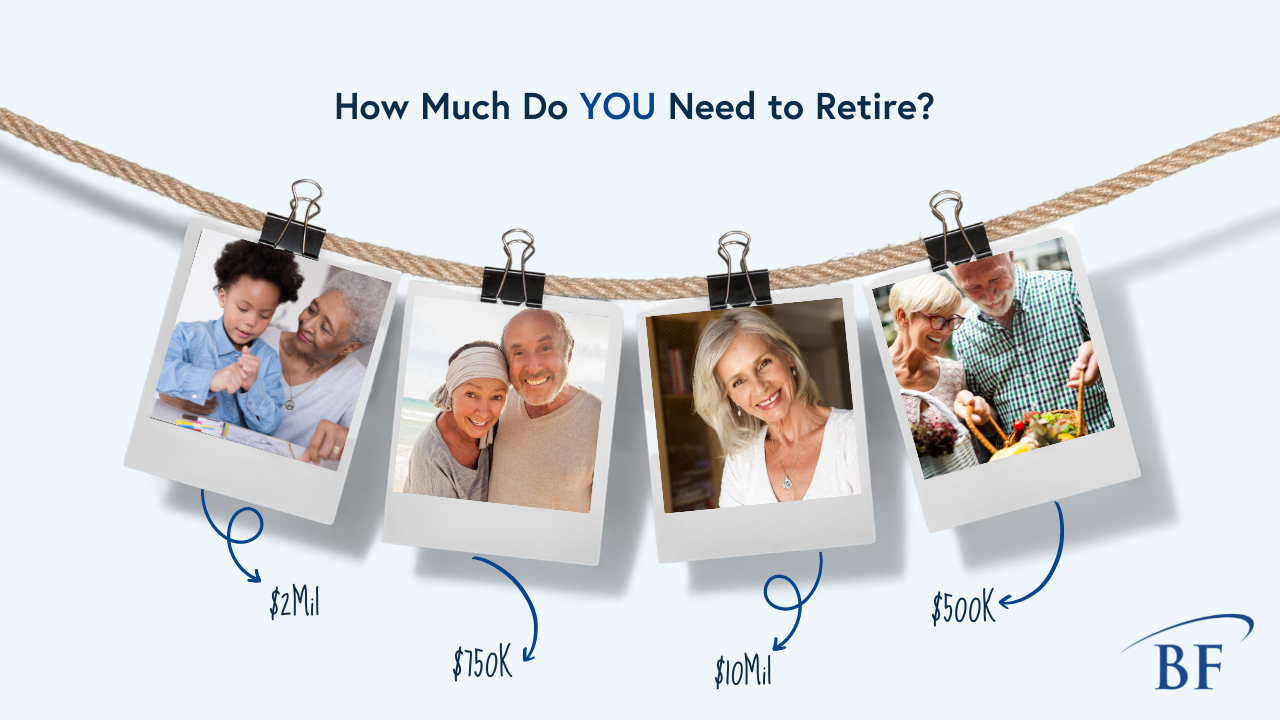

How Much Do YOU Need to Retire?

What a Relief! Congress Acts Against Surprise Medical Bills

If you have ever been caught off-guard by a large medical bill, a long-running practice known as balance billing might be the reason. A balance bill — which is the difference between an out-of-network provider’s normal charges for a service and a lower rate reimbursed by insurance — can amount to thousands of dollars.

Many consumers are already aware that it usually costs less to seek care from in-network health providers, but that’s not always possible in an emergency. Complicating matters, some hospitals and urgent-care facilities rely on physicians, ambulances, and laboratories that are not in the same network. In fact, a recent survey found that 18% of emergency room visits resulted in at least one surprise bill.1

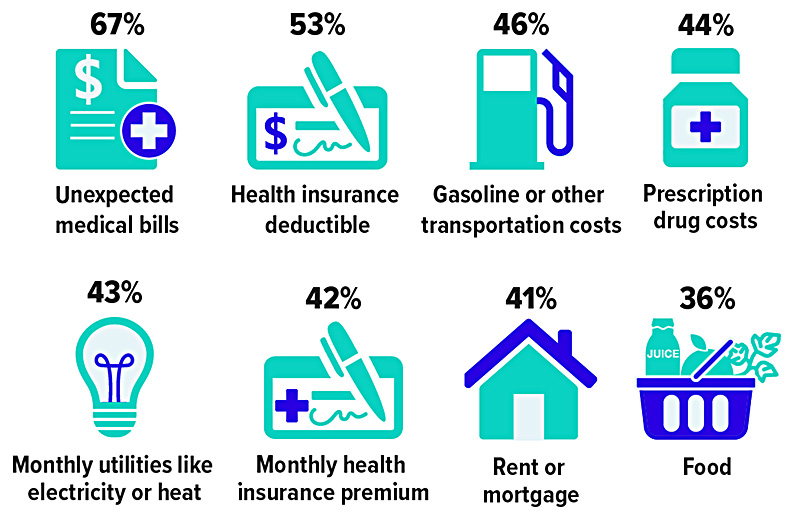

Who’s Afraid of High Health-Care Costs? Most People

Percent of surveyed adults who say they are worried about being able to afford the following expenses

Source: Kaiser Family Foundation and JAMA, 2020

Coming Soon: Comprehensive Protection

The No Surprises Act was included in the omnibus spending bill enacted by the federal government at the end of 2020. The new rules will help ensure that consumers do not receive unexpected bills from out-of-network providers they didn’t choose or had no control over. For example, once the new law takes effect in 2022, patients will not receive balance bills for emergency care or non-emergency care at in-network hospitals when out-of-network providers unknowingly treat them. (A few states already have laws that prevent balance billing unless the patient agrees to costlier out-of-network care ahead of time.)

Patients will be responsible only for the deductibles and copayment amounts they would owe under the in-network terms of their insurance plans. Instead of charging patients, health providers will negotiate a fair price with insurers (and settle disputes with arbitration). This change applies to doctors, hospitals, and air ambulances — but not ground ambulances.

Consent to Pay More

Some patients purposely seek care from out-of-network health providers, such as a trusted family physician or a highly regarded specialist, when they believe the quality of care is worth the extra cost. In these non-emergency situations, physicians can still balance-bill their patients. However, a good-faith cost estimate must be provided, and a consent form must be signed by the patient at least 72 hours before treatment. In addition, some providers are barred from seeking consent to balance-bill for their services, including anesthesiologists, radiologists, pathologists, neonatologists, assistant surgeons, and laboratories.

Big Bills Will Keep Coming

The fact that millions of consumers could be saved from surprise medical bills is something to celebrate. Still, many people may struggle to cover their out-of-pocket health expenses, in some cases because they are uninsured or simply due to high plan deductibles or rising costs in general. Covered workers enrolled in family coverage contributed $5,588, on average, toward the cost of premiums in 2020, with deductibles ranging from $2,700 to more than $4,500, depending on the type of plan.2

When arranging non-emergency surgery or other costly treatment, you may want to take your time choosing a doctor and a facility because charges can vary widely. Don’t hesitate to ask for detailed estimates and try to negotiate a better price.

If you receive a higher-than-expected bill, don’t assume it is set in stone. Check hospital bills closely for errors, check billing codes, and dispute charges that you think insurance should cover. If all else fails, offer to settle your account at a discount.

1-2) Kaiser Family Foundation, 2020