Author: Steve LaFrance

Following the Inflation Debate

Presented by STEPHEN LAFRANCE, CFP®, MBA

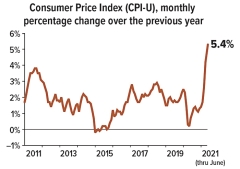

During the 12 months ending in June 2021, consumer prices shot up 5.4%, the highest inflation rate since 2008.1 The annual increase in the Consumer Price Index for All Urban Consumers (CPI-U) — often called headline inflation — was due in part to the “base effect.” This statistical term means the 12-month comparison was based on an unusually low point for prices in the second quarter of 2020 when consumer demand and inflation dropped after the onset of the pandemic.

However, some evident inflationary pressures entered the picture in the first half of 2021. As vaccination rates climbed, pent-up consumer demand for goods and services was unleashed, fueled by stimulus payments and healthy savings accounts built by those with little opportunity to spend their earnings. Many businesses that shut down or cut back when the economy closed could not quickly ramp up enough to meet surging demand. Supply-chain bottlenecks, along with higher costs for raw materials, fuel, and labor, resulted in some troubling price spikes.2

Monitoring Inflation

CPI-U measures the price of a fixed market basket of goods and services. It is a good measure of consumers’ costs if they buy the same items over time, but it does not reflect changes in consumer behavior. Extreme increases can unduly influence it in one or more categories. In June 2021, for example, used-car prices increased 10.5% from the previous month and 45.2% year-over-year, accounting for more than one-third of the increase in CPI. Core CPI, which strips out volatile food and energy prices, rose 4.5% year-over-year.3

The Federal Reserve prefers a different inflation measure called the Personal Consumption Expenditures (PCE) Price Index in setting economic policy. This measure is even broader than the CPI and adjusts for changes in consumer behavior — i.e., when consumers shift to purchase a different item because the preferred thing is too expensive. More specifically, the Fed looks at core PCE, which rose 3.5% through the 12 months ending in June 2021.4

Competing Viewpoints

The perspective held by many economic policymakers, including Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen, was that the spring rise in inflation was due primarily to base effects. As such, temporary supply-and-demand mismatches, so the impact would be mostly “transitory.”5 Regardless, some prices won’t fall back to their former levels once they have risen, and even short-lived bursts of inflation can be painful for consumers.

Some economists fear that inflation may last longer, with more severe consequences, and could become difficult to control. This camp believes that loose monetary policies by the central bank and trillions of dollars in government stimulus have pumped an excess supply of money into the economy. In this scenario, a booming economy and persistent and/or substantial inflation could result in a self-reinforcing feedback loop in which businesses, faced with less competition and expecting higher costs in the future, raise their prices preemptively, prompting workers to demand higher wages.6

Until recently, inflation had consistently lagged the Fed’s 2% target, which it considers a healthy rate for a growing economy, for more than a decade. In August 2020, the Federal Open Market Committee (FOMC) announced that it would allow inflation to rise moderately above 2% for some time to create a 2% average rate over the longer term. This signaled that economists anticipated short-term price swings and assured investors that Fed officials would not overreact by raising interest rates before the economy had fully healed.7

In mid-June 2021, the FOMC projected core PCE inflation to be 3.0% in 2021 and 2.1% in 2022. The benchmark federal funds range was expected to remain at 0.0% to 0.25% until 2023.8 However, Fed officials have also said they are watching the data closely and could raise interest rates sooner, if needed, to cool the economy and curb inflation.

Projections are based on current conditions, are subject to change, and may not come to pass.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

STEPHEN LAFRANCE, CFP®, MBA is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262. 336-885-2530.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

September Market Recap

Markets continued to rally in August, with all three major U.S. indices setting record highs. What does the recent surge in COVID-19 cases mean for the markets moving forward? Stay tuned as Stephen LaFrance, CFP, MBA Certified Financial Planner gives insights on the recent markets! And, as always, speak to us if you have concerns and as always, thank you for your trust and confidence!

Financial Wellness In The New Year

Financial Wellness In The New Year

Presented by STEPHEN LAFRANCE, CFP®, MBA

With the new year comes all sorts of resolutions and goal setting. It is excellent to vow to lose weight, eat healthier, spend more time with your family, etc. but have you taken inventory of your finances and your financial goals? Many of us have probably overspent during the holidays, and it is time to get ahold of our financial health and resolve to get our finances in check.

Achieving money–related balance and financial wellness isn’t necessarily about investing a set dollar amount or your ability to pay for something expensive without flinching. It is much broader. It is about getting your entire house in order. It can be as simple as chatting about starting your travel fund, saving $20 a month, or whether or not your company offers a 401(k) match. Financial independence allows us to live the life that we want. It is about developing a healthy relationship with money and feeling a sense of control over short-term obligations while working toward those long-term goals.

An essential first step towards financial wellness is actively talking about your finances. That is not to say you have to divulge personal details about your savings and debt to your whole group of friends, but choosing a mentor or meeting with a financial advisor to put together an action plan can help.

Here are some tips to help get you on the path to financial wellness.

- Develop goals and identify priorities.

- Assess your current assets and resources.

- Identify any barriers to achieving your goals. For example, if you have student debt or large balances on credit cards, tackle these. Then, work with a credit counselor to consolidate your debt and make it more manageable to pay off.

- Incorporate strategies into your plan like brewing your coffee and preceding that $3 cup from the local chain coffee shop. It’s incredible how small steps add up fast.

- Put your plan into action. Start saving more for your retirement. Even if it increases your contribution to your 401(k) by just 1% each year, the long-term benefit of this will surprise you.

- Consider looking into long-term care insurance. According to the statistics, we are all living longer, and more than 70 percent of Americans will require some care in their later years. Talk to your financial advisor today and see which LTC coverage is best for you.

- Monitor your progress, evaluate where you are, and adjust your plan as necessary.

Good planning and consulting with a financial advisor can take some stress out of your life and get you on the path to financial wellness today!

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

STEPHEN LAFRANCE, CFP®, MBA is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262. 336-885-2530.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Year-End Planning Strategies

Presented by STEPHEN LAFRANCE, CFP®, MBA

The window of opportunity for many tax-saving moves closes on December 31, so it is important to evaluate your tax situation now, while there is still time to affect your bottom line for the 2020 tax year.

Timing is everything

Consider any income opportunities you may be able to defer until 2021. For example, you may consider deferring a year-end bonus, or delaying the collection of business debts, rents, and payments for services. Doing so may allow you to postpone paying tax on the income until next year. If there’s a chance that you’ll be in a lower income tax bracket next year, deferring income could mean paying less tax on the income as well.

Similarly, consider ways to accelerate deductions into 2020. If you itemize deductions, you might accelerate some deductible expenses like medical expenses, qualifying interest, or state and local taxes by making payments before year-end. Or you might consider making next year’s charitable contribution this year instead.

Sometimes, however, it may make sense to take the opposite approach — accelerating income into 2020 and postponing deductible expenses to 2021. That might be the case, for example, if you can project that you’ll be in a higher tax bracket in 2021; paying taxes this year instead of next might be outweighed by the fact that the income would be taxed at a higher rate next year.

Special concerns for higher-income individuals

The top marginal tax rate (37%) applies if your taxable income exceeds $518,400 in 2020 ($622,050 if married filing jointly, $311,025 if married filing separately). Your long-term capital gains and qualifying dividends could be taxed at a maximum 20% tax rate if your taxable income exceeds $441,450 in 2020 ($496,600 if married filing jointly, $248,300 if married filing separately, $469,050 if head of household).

Additionally, a 3.8% net investment income tax (unearned income Medicare contribution tax) may apply to some or all of your net investment income if your modified AGI exceeds $200,000 ($250,000 if married filing jointly, $125,000 if married filing separately).

The 2017 Tax Cuts and Jobs Act (TCJA) substantially reduced the number of households affected by the alternative minimum tax (AMT). If you’re subject to the AMT, traditional year-end maneuvers, like deferring income and accelerating deductions, can have a negative effect. That’s because the AMT — essentially a separate, parallel income tax with its own rates and rules — effectively disallows a number of itemized deductions. For example, if you’re subject to the AMT in 2020, prepaying 2021 state and local taxes won’t help your 2020 tax situation, but could hurt your 2021 bottom line.

High-income individuals are subject to an additional 0.9% Medicare (hospital insurance) payroll tax on wages exceeding $200,000 ($250,000 if married filing jointly or $125,000 if married filing separately).

IRAs and retirement plans

Take full advantage of tax-advantaged retirement savings vehicles. Traditional IRAs and employer-sponsored retirement plans such as 401(k) plans allow you to contribute funds on a deductible (if you qualify) or pre-tax basis, reducing your 2020 taxable income. Contributions to a Roth IRA (assuming you meet the income requirements) or a Roth 401(k) aren’t deductible or made with pre-tax dollars, so there’s no tax benefit for 2020, but qualified Roth distributions are completely free from federal income tax, which can make these retirement savings vehicles appealing.

For 2020, you can contribute up to $19,500 to a 401(k) plan ($26,000 if you’re age 50 or older) and up to $6,000 to a traditional IRA or Roth IRA ($7,000 if you’re age 50 or older). The window to make 2020 contributions to an employer plan typically closes at the end of the year, while you generally have until the April tax return filing deadline to make 2020 IRA contributions.

Roth conversions

Year-end is a good time to evaluate whether it makes sense to convert a tax-deferred savings vehicle like a traditional IRA or a 401(k) account to a Roth account. When you convert a traditional IRA to a Roth IRA, or a traditional 401(k) account to a Roth 401(k) account, the converted funds are generally subject to federal income tax in the year that you make the conversion (except to the extent that the funds represent nondeductible after-tax contributions). If a Roth conversion does make sense, you’ll want to give some thought to the timing of the conversion. For example, if you believe that you’ll be in a better tax situation this year than next (e.g., you would pay tax on the converted funds at a lower rate this year), you might think about acting now rather than waiting. (Whether a Roth conversion is appropriate for you depends on many factors, including your current and projected future income tax rates.)

Previously, if you converted a traditional IRA to a Roth IRA and it turned out to be the wrong decision (things didn’t go the way you planned and you realized that you would have been better off waiting to convert), you could recharacterize (i.e., “undo”) the conversion. Recent legislation has eliminated the option to recharacterize a Roth IRA conversion.

Charitable Giving

Charitable giving can play an important role in many estate plans. Philanthropy cannot only give you great personal satisfaction, it can also give you a current income tax deduction, let you avoid capital gains tax, and reduce the amount of taxes your estate may owe when you die.

There are many ways to give to charity. You can make gifts during your lifetime or at your death. You can make gifts outright or use a trust. You can name a charity as a beneficiary in your will, or designate a charity as a beneficiary of your retirement plan or life insurance policy. Or, if your gift is substantial, you can establish a private foundation, community foundation, or donor-advised fund.

Making outright gifts

An outright gift is one that benefits the charity immediately and exclusively. With an outright gift, you get an immediate income and gift tax deduction.

Make sure the charity is a qualified charity according to the IRS. Get a written receipt or keep a bank record for any cash donations, and get a written receipt for any property other than money.

Will or trust bequests and beneficiary designations

These gifts are made by including a provision in your will or trust document, or by using a beneficiary designation form. The charity receives the gift at your death, at which time your estate can take the income and estate tax deductions.

Charitable trusts

Another way for you to make charitable gifts is to create a charitable trust. You can name the charity as the sole beneficiary, or you can name a non-charitable beneficiary as well, splitting the beneficial interest (this is referred to as making a partial charitable gift). The most common types of trusts used to make partial gifts to charity are the charitable lead trust (CLT) and the charitable remainder trust (CRT).

Charitable trusts generally make sense when your total estate value is near or exceeds the federal estate tax exemption amount of $11.58 million for individuals and $23.16 million for married couples.

Private family foundation

A private family foundation is a separate legal entity that can endure for many generations after your death. You create the foundation, then transfer assets to the foundation, which in turn makes grants to public charities. You and your descendants have complete control over which charities receive grants. But, unless you can contribute enough capital to generate funds for grants, the costs and complexities of a private foundation may not be worth it.

A general guideline is that you should be able to donate enough assets to generate at least $25,000 a year for grants.

Community foundation

If you want your dollars to be spent on improving the quality of life in a particular community, consider giving to a community foundation. Similar to a private foundation, a community foundation accepts donations from many sources, and is overseen by individuals familiar with the community’s particular needs, and professionals skilled at running a charitable organization.

Donor-advised fund

Similar in some respects to a private foundation, a donor-advised fund offers an easier way for you to make a significant gift to charity over a long period of time. A donor-advised fund actually refers to an account that is held within a charitable organization. The charitable organization is a separate legal entity, but your account is not — it is merely a component of the charitable organization that holds the account. Once you transfer assets to the account, the charitable organization becomes the legal owner of the assets and has ultimate control over them. You can only advise — not direct — the charitable organization on how your contributions will be distributed to other charities.

Changes to note

The 2017 TCJA also modified many provisions, generally for 2018 to 2025.

- Personal exemptions were eliminated.

- Standard deductions have been substantially increased to $12,400 in 2020 ($24,800 if married filing jointly, $18,650 if head of household).

- The overall limitation on itemized deductions based on the amount of adjusted gross income (AGI) was eliminated.

The AGI threshold for deducting unreimbursed medical expenses is 7.5% in 2020, it returns to 10% in 2021. - The deduction for state and local taxes has been limited to $10,000 ($5,000 if married filing separately).

- Individuals can deduct mortgage interest on no more than $750,000 ($375,000 for married filing separately) of qualifying mortgage debt. For mortgage debt incurred before December 16, 2017, the prior $1,000,000 ($500,000 for married filing separately) limit will continue to apply. A deduction is no longer allowed for interest on home equity indebtedness. Home equity used to substantially improve your home is not treated as home equity indebtedness and can still qualify for the interest deduction.

- The top percentage limit for deducting charitable contributions was increased from 60% of AGI to 100% of AGI for certain direct cash gifts to public charities for 2020.

- The deduction for personal casualty and theft losses was eliminated, except for casualty losses attributable to a federally declared disaster.

- Previously deductible miscellaneous expenses subject to the 2% floor, including tax-preparation expenses and unreimbursed employee business expenses, are no longer deductible.

Extended provisions

A number of provisions are extended periodically. The following provisions have been extended through 2020 and are not available for 2021 unless extended by Congress.

- Above-the-line deduction for qualified higher-education expenses.

- Ability to deduct qualified mortgage insurance premiums as deductible interest on Schedule A of IRS Form 1040.

- Ability to exclude from income amounts resulting from the forgiveness of debt on a qualified principal residence.

- Nonbusiness energy property credit, which allowed individuals to offset some of the cost of energy-efficient qualified home improvements (subject to a $500 lifetime cap).

Talk to a professional for guidance

When it comes to year-end tax planning, there’s always a lot to think about. A tax professional or financial planning professional can help you evaluate your situation, keep you apprised of any legislative changes, and determine whether any year-end moves make sense for you.

Engage with the entire Blakely Financial team at www.blakelyfinancial.com to see what other financial tips we can provide towards your financial well-being.

STEPHEN LAFRANCE, CFP®, MBA is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262. 336-885-2530.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Prepared by Broadridge Advisor Solutions

Tap and Go: Understanding Mobile Payments

Presented by STEPHEN LAFRANCE, CFP®, MBA

Purchasing items with your phone may seem complex, but getting started is much easier than you may think.

Carrying around a hefty, jam-packed wallet is starting to fall out of style—just like bell-bottomed jeans and leg warmers. Instead, many are embracing the advent of mobile payment methods and turning to their smartphones to make payments.

More than 58 million American adults have made a mobile payment, and analysts predict that usage in North America will more than double by 2025.1 A mobile payment refers to a digital transaction that occurs through a mobile device (you may hear the term mobile wallet used as well).

Making purchases with your phone can seem intimidating. Here’s what you should know about paying through your touch screen.

How Safe Are Mobile Payment Methods?

You may feel hesitant to type or scan your credit card or bank account information into your phone. However, mobile payment methods may actually be safer than using a credit card or cash.

Mobile wallet apps such as Apple Pay, Google Pay, and Samsung Pay use near-field communications (NFC) to convey transactions between your phone and the terminal. You may have witnessed the person in front of you in the grocery store line pay for their food by holding their phone near the chip reader. They were likely using NFC. The person’s credit card information traveled directly to the terminal without crossing through the internet.

Most mobile payment methods also encrypt your personal information using tokenization, a process in which your bank details are stored as a series of randomly generated numbers (tokens) instead of your actual information. Tokenization ensures that account details on your phone can’t be cloned and are less vulnerable to fraud. Apple, Google, and Samsung Pay add an additional level of protection with their fingerprint or facial recognition features.

Due to these multiple layers of security, many people consider mobile payment methods to be safer than paying with a physical credit card that is subject to fraud and theft.

What Mobile Payment Methods Should I Consider Using?

Apple Pay, Google Pay, and Samsung Pay are all standard mobile payment methods that can be connected to your credit card. At least one of them should already be installed on your smartphone, and they all work in essentially the same way (check your phone settings to see which one you have). Besides their convenience and easy set-up, these three mobile payment methods have so far proven to be secure and could save you some time in the checkout line.

PayPal functions in a similar way, except that users often connect it directly to their bank accounts. It originally became popular as a payment method for online shopping, and some brick-and-mortar stores now accept it.

Venmo is another popular payment method, although its purpose is slightly different. Venmo is generally used in a social context as an easy way to split a check at a restaurant or to repay a friend for a purchase. You should only give or receive mobile money through Venmo with people you know.

How Can I Get Started?

Mobile payment method apps are intended to be user-friendly. Start by searching for Apple Pay, Google Pay, or Samsung Pay in your smartphone’s settings, or download the Paypal or Venmo app. Just make sure you choose a secure password when you’re ready to get started.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

STEPHEN LAFRANCE, CFP®, MBA is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262. 336-885-2530.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Prepared by Hartford Funds

Life Insurance Awareness

Presented by STEPHEN LAFRANCE, CFP®, MBA

How much life insurance do you need?

Your life insurance needs will depend on a number of factors, including the size of your family, the nature of your financial obligations, your career stage, and your goals. For example, when you’re young, you may not have a great need for life insurance. However, as you take on more responsibilities and your family grows, your need for life insurance increases.

Here are some questions that can help you start thinking about the amount of life insurance you need:

- What immediate financial expenses (e.g., debt repayment, funeral expenses) would your family face upon your death?

- How much of your salary is devoted to current expenses and future needs?

- How long would your dependents need support if you were to die tomorrow?

- How much money would you want to leave for special situations upon your death, such as funding your children’s education, gifts to charities, or an inheritance for your children?

- What other assets or insurance policies do you have?

Types of life insurance policies

The two basic types of life insurance are term life and permanent (cash value) life. Term policies provide life insurance protection for a specific period of time. If you die during the coverage period, your beneficiary receives the policy’s death benefit. If you live to the end of the term, the policy simply terminates, unless it automatically renews for a new period. Term policies are typically available for periods of 1 to 30 years and may, in some cases, be renewed until you reach age 95. With guaranteed level term insurance, a popular type, both the premium and the amount of coverage remain level for a specific period of time.

Permanent insurance policies offer protection for your entire life, regardless of your health, provided you pay the premium to keep the policy in force. As you pay your premiums, a portion of each payment is placed in the cash-value account. During the early years of the policy, the cash-value contribution is a large portion of each premium payment. As you get older, and the true cost of your insurance increases, the portion of your premium payment devoted to the cash value decreases. The cash value continues to grow–tax deferred–as long as the policy is in force. You can borrow against the cash value, but unpaid policy loans will reduce the death benefit that your beneficiary will receive. If you surrender the policy before you die (i.e., cancel your coverage), you’ll be entitled to receive the cash value, minus any loans and surrender charges.

Many different types of cash-value life insurance are available, including:

- Whole life: You generally make level (equal) premium payments for life. The death benefit and cash value are predetermined and guaranteed (subject to the claims-paying ability and financial strength of the issuing insurance company). Your only action after purchase of the policy is to pay the fixed premium.

- Universal life: You may pay premiums at any time, in any amount (subject to certain limits), as long as the policy expenses and the cost of insurance coverage are met. The amount of insurance coverage can be changed, and the cash value will grow at a declared interest rate, which may vary over time.

- Indexed universal life: This is a form of universal life insurance with excess interest credited to cash values. But unlike universal life insurance, the amount of interest credited is tied to the performance of an equity index, such as the S&P 500.

- Variable life: As with whole life, you pay a level premium for life. However, the death benefit and cash value fluctuate depending on the performance of investments in what are known as subaccounts. A subaccount is a pool of investor funds professionally managed to pursue a stated investment objective. You select the subaccounts in which the cash value should be invested.

- Variable universal life: A combination of universal and variable life. You may pay premiums at any time, in any amount (subject to limits), as long as policy expenses and the cost of insurance coverage are met. The amount of insurance coverage can be changed, and the cash value and death benefit goes up or down based on the performance of investments in the subaccounts.

With so many types of life insurance available, you’re sure to find a policy that meets your needs and your budget.

Choosing and changing your beneficiaries

When you purchase life insurance, you must name a primary beneficiary to receive the proceeds of your insurance policy. Your beneficiary may be a person, corporation, or other legal entity. You may name multiple beneficiaries and specify what percentage of the net death benefit each is to receive. If you name your minor child as a beneficiary, you should also designate an adult as the child’s guardian in your will.

What type of insurance is right for you?

Before deciding whether to buy term or permanent life insurance, consider the policy cost and potential savings that may be available. Also keep in mind that your insurance needs will likely change as your family, job, health, and financial picture change, so you’ll want to build some flexibility into the decision-making process. In any case, here are some common reasons for buying life insurance and which type of insurance may best fit the need.

Mortgage or long-term debt: For most people, the home is one of the most valuable assets and also the source of the largest debt. An untimely death may remove a primary source of income used to pay the mortgage. Term insurance can replace the lost income by providing life insurance for the length of the mortgage. If you die before the mortgage is paid off, the term life insurance pays your beneficiary an amount sufficient to pay the outstanding mortgage balance owed.

Family protection: Your income not only pays for day-to-day expenses but also provides a source for future costs such as college education expenses and retirement income. Term life insurance of 20 years or longer can take care of immediate cash needs as well as provide income for your survivor’s future needs. Another alternative is cash value life insurance, such as universal life or variable life insurance. The cash value accumulation of these policies can be used to fund future income needs for college or retirement, even if you don’t die.

Small business needs: Small business owners need life insurance to protect their business interests. As a business owner, you need to consider what happens to your business should you die unexpectedly. Life insurance can provide the cash needed to buy a deceased partner’s or shareholder’s interest from his or her estate. Life insurance can also be used to compensate for the unexpected death of a key employee.

Review your coverage

Once you purchase a life insurance policy, make sure to periodically review your coverage; over time your needs will change. An insurance agent or financial professional can help you with your review.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

STEPHEN LAFRANCE, CFP®,MBA is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262, and can be reached at 336-885-2530.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Prepared by Broadridge Advisor Solutions

Finance101: Dealing With Student Debt Now & Later

Presented by STEPHEN LAFRANCE, CFP®, MBA

The last thing on your mind as a college student is saving money, budgeting and managing your debt. But if you are not careful, college can create a future full of debt and angst over bills to pay and credit card debt. We would like to share some thoughts on managing your debt while you are in college.

- Budgeting

Create a budget that is realistic and be disciplined about your expenses. Stick with it as the more you live within your means now, the faster you can move towards your goals in the future.

- Get a Job and Start Saving

By sacrificing and working a part-time job on weekends, during breaks and some after class you can begin to make extra money to help pay off those student loans and other expenses you accrue. You will be in such a better spot when you graduate.

- Be Smart About Credit Cards

College students are hounded with, what sound like great offers for credit cards. Applying for one credit card in your name helps build good credit; however, using it for purchases that you cannot afford and racking up debt at very high interest rates will jeopardize your financial future. Be smart and put the credit card away!

- Cut Costs Where You Can

Buy used textbooks; purchase a coffee maker and reduce the expensive coffees you purchase every day; cut back on your meal plan if you find you are not utilizing the entire plan each year – these are just a few ways you can cut some expenses. The little things will add up fast.

- Start an Emergency Fund

It is always helpful to put some of your earnings into an emergency fund, just in case you find yourself with an unexpected expense.

Upon Graduation:

- Pick Your Loan Repayment Plan

Each plan is different and is dependent upon your level of student debt. Speak to your financial aid office for direction on your repayment of your student loans.

- Consolidate Your Loans

Once you graduate, normally you have six months before you begin paying back your loans. However, just because you have six months does not mean you have to wait. Begin right away paying off your loans as it will easily become a habit. And, speaking to the right institution and consolidating your loans will make it easier to keep track of what you owe.

- Look Into Loan Forgiveness Programs

Some loans will allow you to push the time to pay them off and some careers allow for some of the debt to be forgiven. Make sure you do the research to get the most benefits.

- Avoid More Debt

It is natural to want to purchase fun stuff upon graduation; however, taking on more debt when you have student loans to pay off is not recommended.

Keeping on top of your expenses and developing a healthy relationship with money now will pay dividends in the future. Always remember not to take on debt you cannot afford. You will reap the rewards later.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

STEPHEN LAFRANCE, CFP®,MBA is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262. 336-885-2530.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Authored by the Investment Research team at Commonwealth Financial Network

Planning Life’s Biggest Vacation: Employer-Sponsored Retirement Plans

Presented by STEPHEN LAFRANCE, CFP®, MBA

Planning for life’s biggest vacation takes discipline and a little bit of work on the front end. Having conversations with your financial advisor to identify your goals and dreams for retirement now will get you on the path to the best vacation ever!

Did you know that many people do not participate in their employer’s retirement plan because they believe they do not make enough money or because they feel they lack the knowledge about why to participate? One of the best ways to save for retirement is to take advantage of your employer’s retirement plan.

Employer-sponsored qualified retirement plans such as 401(k)s are some of the most powerful retirement savings tools available. If your employer offers such a plan and you are not participating in it, you should be. Once you are participating in a plan, try to take full advantage of it.

Understand your employer-sponsored plan

Before you can take advantage of your employer’s plan, you need to understand how these plans work. Read everything you can about the plan and talk to your employer’s benefits officer. You can also talk to a financial planner, a tax advisor, and other professionals. Recognize the key features that many employer-sponsored plans share:

- Your employer automatically deducts your contributions from your paycheck. You may never even miss the money — out of sight, out of mind.

- You decide what portion of your salary to contribute, up to the legal limit. And you can usually change your contribution amount on certain dates during the year or as needed.

- With 401(k), 403(b), 457(b), SARSEPs, and SIMPLE plans, you contribute to the plan on a pre-tax basis. Your contributions come off the top of your salary before your employer withholds income taxes.

- Your 401(k), 403(b), or 457(b) plan may let you make after-tax Roth contributions — there’s no up-front tax benefit but qualified distributions are entirely tax free.

- Your employer may match all or part of your contribution up to a certain level. You typically become vested in these employer dollars through years of service with the company.

- Your funds grow tax deferred in the plan. You don’t pay taxes on investment earnings until you withdraw your money from the plan.

- You’ll pay income taxes (and possibly an early withdrawal penalty) if you withdraw your money from the plan.

- You may be able to borrow a portion of your vested balance (up to $50,000) at a reasonable interest rate.

- Your creditors cannot reach your plan funds to satisfy your debts.

Contribute as much as possible

The more you can save for retirement, the better chance you have of retiring comfortably. If you can, max out your contribution up to the legal limit (or plan limits, if lower). If you need to free up money to do that, try to cut certain expenses.

Why put your retirement dollars in your employer’s plan instead of somewhere else? One reason is that your pre-tax contributions to your employer’s plan lower your taxable income for the year. This means you save money in taxes when you contribute to the plan — a big advantage if you’re in a high tax bracket. For example, if you earn $100,000 a year and contribute $10,000 to a 401(k) plan, you’ll pay income taxes on $90,000 instead of $100,000. (Roth contributions don’t lower your current taxable income but qualified distributions of your contributions and earnings — that is, distributions made after you satisfy a five-year holding period and reach age 59½, become disabled, or die — are tax free.)

Another reason is the power of tax-deferred growth. Your investment earnings compound year after year and aren’t taxable as long as they remain in the plan. Over the long term, this gives you the opportunity to build an impressive sum in your employer’s plan. You should end up with a much larger balance than somebody who invests the same amount in taxable investments at the same rate of return.

For example, say you participate in your employer’s tax-deferred plan (Account A). You also have a taxable investment account (Account B). Each account earns 6% per year. You’re in the 24% tax bracket and contribute $5,000 to each account at the end of every year. After 40 years, the money placed in a taxable account would be worth $567,680. During the same period, the tax-deferred account would grow to $820,238. Even after taxes have been deducted from the tax-deferred account, the investor would still receive $623,381. (Note: This example is for illustrative purposes only and does not represent a specific investment.)

Capture the full employer match

If you can’t max out your 401(k) or other plan, you should at least try to contribute up to the limit your employer will match. Employer contributions are basically free money once you are vested in them (check with your employer to find out when vesting happens). By capturing the full benefit of your employer’s match, you will be surprised how much faster your balance grows. If you do not take advantage of your employer’s generosity, you could be passing up a significant return on your money.

For example, you earn $30,000 a year and work for an employer that has a matching 401(k) plan. The match is 50 cents on the dollar up to 6% of your salary. Each year, you contribute 6% of your salary ($1,800) to the plan and receive a matching contribution of $900 from your employer.

Evaluate your investment choices carefully

Most employer-sponsored plans give you a selection of mutual funds or other investments to choose from. Make your choices carefully. The right investment mix for your employer’s plan could be one of your keys to a comfortable retirement. That’s because over the long term, varying rates of return can make a big difference in the size of your balance.

Note: Before investing in a mutual fund, carefully consider the investment objectives, risks, charges, and expenses of the fund. This information can be found in the prospectus, which can be obtained from the fund. Read it carefully before investing.

Research the investments available to you. How have they performed over the long term? How much risk will they expose you to? Which ones are best suited for long-term goals like retirement? You may also want to get advice from a financial professional (either your own, or one provided through your plan). He or she can help you pick the right investments based on your personal goals, your attitude toward risk, how long you have until retirement, and other factors. Your financial professional can also help you coordinate your plan investments with your overall investment portfolio.

Know your options when you leave your employer

When you leave your job, your vested balance in your former employer’s retirement plan is yours to keep. You have several options at that point, including:

- Taking a lump-sum distribution. Before choosing this option, consider that you’ll pay income taxes and possibly a penalty on the amount you withdraw. Plus, you’re giving up the continued potential of tax-deferred growth.

- Leaving your funds in the old plan, growing tax deferred. (Your old plan may not permit this if your balance is less than $5,000, or if you’ve reached the plan’s normal retirement age — typically age 65.) This may be a good idea if you’re happy with the plan’s investments or you need time to decide what to do with your money.

- Rolling your funds over to an IRA or a new employer’s plan (if the plan accepts rollovers). This may also be an appropriate move because there will be no income taxes or penalties if you do the rollover properly (your old plan will withhold 20% for income taxes if you receive the funds before rolling them over, and you’ll need to make up this amount out of pocket when investing in the new plan or IRA). Plus, your funds continue to potentially benefit from tax-deferred growth.

By taking advantage of your employer’s retirement plan, in conjunction with regular review meetings with your financial advisor, planning for the biggest vacation of your life will be easier than ever. And the earlier you can start, the better off you will be. Make sure to take the time now to put those plans in place. You will be so glad you did!

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

STEPHEN LAFRANCE, CFP®,MBA is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262. 336-885-2530.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Prepared by Broadridge Advisor Solutions

A Closer Look At Saving For Education Using A 529 Plan

Presented by STEPHEN LAFRANCE, CFP®, MBA

Since it is National 529 Day, we thought it would be appropriate to take a closer look at saving for education through a 529 plan. We will also compare a few other options that may make sense for you, depending on your specific situation.

What is a 529 Plan?

A 529 plan is generally a qualified tuition program created by the government in the 90s to incentivize saving for educational goals. The “529” comes from the location of the rules governing the program in section 529 of the Internal Revenue Code.

There are two types of 529 plans: prepaid tuition and savings plans. The latter is the most popular as the prepaid plans allow you to prepay tuition at today’s prices, typically reserved for participating in-state public universities. On the other hand, savings plans are much less restrictive and more popular than prepaid plans.

While the IRS governs the plans, individual states create them to allow for states to tailor them to their needs, specific to their university system. While most states offer at least one plan, there are multiple plans in some states. However, you can use any 529 plan, regardless of its originating state. Check with your state’s plan for potential tax deductions on contributions or tax-free earnings on qualified withdrawals. If you don’t have a specific state tax benefit, there could be a better option with another state’s plan.

Investment Options

Every 529 plan will have a different lineup of investment options that you can use with varying costs and features. You’ll want to make sure you choose a plan with investment options that match your risk tolerance and goals. Most 529 plans offer age-based investment options that adjust as your child gets older and closer to using funds, which is helpful as you want to make sure the aggressiveness of the portfolio matches the time horizon of the goal. These model portfolios are ideal, given a limit of two changes to investment elections per year in 529 plans.

Fees & Expenses

The difference in fees and expenses can drastically separate some plans. Some may offer only one option, while others may offer several share classes of investments. You’ll want to consult with your financial advisor to determine which is best based on your goals. Depending on the plan, advisors are compensated differently, so ask your advisor how they are paid. Some state plans are not available for use by financial advisors. Ask your financial advisor about the differences between advisor-sold plans and non-advisor-sold plans. You may prefer to pay a commission to your advisor through the investment options. Alternatively, you may choose to find a fee-only plan. Your advisor charges you a flat fee either one time or annually to advise you on investment options and/or assist with processing contributions/withdrawals. If you are confident that you can make those decisions and want to handle the operational portion, then a non-advisor sold plan might be best for you.

Whether you choose a plan through an advisor or not, choosing a reputable financial institution with good customer service is essential. It’s also important to consider ease of use. Is their website easy to navigate? Can you process contributions and withdrawals online? Can you make address changes, automatic investment changes, or add a bank account online? Do you want to do all those things yourself or have an advisor do it? As a reminder, whether you end up using one or not, it’s essential to consult with a financial advisor when making these decisions.

Qualified Withdrawals

One of the most important aspects to understand about 529s is what expenses are qualified, meaning you don’t pay taxes on the growth of the funds when you make a withdrawal. That is the primary driver for why people choose to use a 529 versus other savings vehicles. Still, it can add some complexity as you have to keep track of expenses and make sure you match withdrawals with eligible costs.

These qualified expenses have always included the total cost of tuition, fees, books, equipment, and room and board of accredited colleges or universities in the United States. More recently, the plans were expanded to allow $10,000 per year for K-12 expenses and a $10,000 lifetime limit per beneficiary for student loan repayment. You can also move funds to pay off up to $10,000 of student loans for the beneficiary’s siblings. In addition, there is an existing plan called a Coverdell ESA designed to save for K-12 expenses, but these are obsolete with the expansion of 529s to include K-12 costs.

Contributions

One of the benefits of 529s is that anyone can contribute to them, whether the parents, grandparents, friends or even the beneficiary themselves. This flexibility means you don’t have to open separate accounts for each contributor, and all the funds can be held for each beneficiary. However, siblings do need to have individual accounts. You can always move funds for a 529 to the account of a family member without penalty. We won’t delve into specific rules here, but these transfers can be to parents, in-laws, and even first cousins.

Grandparents & FAFSA

If the students plan to fill out the FAFSA (Free Application for Federal Student Aid), it would be best to open 529s in the grandparents’ name to avoid including these assets in the FAFSA. Students’ and parents’ assets are included, but grandparents are not. This is a popular planning strategy for wealthy grandparents trying to efficiently draw down their estate with the least taxes or penalties. There are other factors to consider with that strategy, so it is best to consult with a financial advisor to help determine the best course of action for your specific situation. Also, keep in mind the estate and tax ramifications if the grandparents pass away still owning the assets. If keeping the assets out of the parents’ name seems attractive, consult with a financial advisor or estate planning attorney to understand what else might need to be done.

Should you use a 529?

After walking through the specifics of what a 529 is, and the existing rules and limitations, many ask if all the headache is worth it? The most significant benefit you can get from a 529 is the compounding time value of money. Given that the goal starts at birth, usually as an 18-22 year funding goal, that time horizon begins shrinking immediately. As that happens, the ability for the funds to grow substantially starts shrinking as well. Even if you start at birth, a typical age-based portfolio will be predominantly fixed income ten years before the end of the spending goal for a child that begins college on time and earns a four-year degree.

If you start saving at birth, the tax savings and the time value of money are compelling reasons to use a 529 if you are confident your child will go to a four-year university. However, if that isn’t a certainty in your mind, or you are getting a late start to saving, there might be some other alternatives that I alluded to earlier.

Custodial Account Option (UTMA \ UGMA)

If you trust your child or think you will be able to trust them when they reach adulthood, a custodial account may be a great option. The funds in the account are deemed irrevocable gifts to the child but can be used for their benefit before they can take control at 18 or 21 (depending on the state), including to pay for college. Earnings are taxed at your child’s tax rate, subject to kiddie tax rules, but for the most part, the taxes are virtually zero throughout their time as a minor if appropriately managed. If you are seriously considering this option, it would be best to consult your tax advisor to see if the kiddie tax rules would apply, etc.

Roth IRA’s?

While technically not an account typically used for college savings, if you can contribute to a Roth IRA, you might want to consider this option. You can always take out your contributions to a Roth IRA free of taxes. While they would be subject to income tax, the earnings are spared the tax penalty if used for education. It may not be the best option, but if you want to use a few different options for funding the goal, you should consider this.

Last resort

If you aren’t sure your child will go to college, aren’t willing to trust them with your hard-earned money when they reach adulthood, and aren’t eligible to contribute to a Roth IRA, maybe a simple savings or taxable investment account would be best. The one point I want to get across is that no matter what type of account you choose, the most critical decision you can make is to save for your goals.

As I have said many times, should you have questions about how this applies to you, please consult with the appropriate advisor, whether related to taxes, investments, or legal concerns.

Engage with the Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide for your financial well-being.

STEPHEN LAFRANCE, CFP®, MBA is a financial advisor with BLAKELY FINANCIAL, INC., located at 1022 Hutton Ln., Suite 109, High Point, NC 27262, and can be reached at 336-885-2530.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Authored by the Investment Research team at Commonwealth Financial Network