Contributing to an employer-sponsored retirement plan or an IRA is a big step on the road to retirement, but contributing to both can significantly boost your retirement assets. A recent study found that, on average, individuals who owned both a 401(k) and an IRA at some point during the six years of the survey had combined balances about 2.5 times higher than those who owned only a 401(k) or an IRA. And people who owned both types of accounts consistently over the period had even higher balances.1

Here is how the two types of plans can work together in your retirement savings strategy.

Convenience vs. Control

Employer-sponsored plans such as 401(k), 403(b), and 457(b) plans offer a convenient way to save through pre-tax salary deferrals, and contribution limits are high: $19,500 in 2021 ($20,500 in 2022) and an additional $6,500 if age 50 or older. Although the costs for investments offered in the plan may be lower than those provided in an IRA, these plans typically offer limited investment choices and have restrictions on control over the account.

IRA contribution limits are much lower: $6,000 in 2021 and 2022 ($7,000 if age 50 or older). But you can usually choose from a wide variety of investments, and the account is yours to control and keep regardless of your employment situation. For example, if you leave your job, you can roll assets in your employer plan into your IRA.2. In contrast, contributions to an employer plan generally must be made by December 31; you can contribute to an IRA up to the April tax filing deadline.

Matching and Diversification

Many employer plans match a percentage of your contributions. If your employer offers this program, it would be wise to contribute enough to receive the entire match. Of course, contributing more would be better, but you also might consider funding your IRA, especially if the contributions are deductible (see below).

Along with the flexibility and control offered by the IRA, holding assets in both types of accounts, with different underlying investments, could help diversify your portfolio. Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss.

Rules and Limits

Although annual contribution limits for employer plans and IRAs are separate, your ability to deduct traditional IRA contributions phases out at higher income levels if you are covered by a workplace plan: modified adjusted gross income (MAGI) of $66,000 to $76,000 for single filers and $105,000 to $125,000 for joint filers in 2021 ($68,000 to $78,000 and $109,000 to $129,000 in 2022).3 You can make nondeductible contributions to a traditional IRA regardless of income.

Eligibility to contribute to a Roth IRA phases out at higher income levels regardless of coverage by a workplace plan: MAGI of $125,000 to $140,000 for single filers and $198,000 to $208,000 for joint filers in 2021 ($129,000 to $144,000 and $204,000 to $214,000 in 2022).

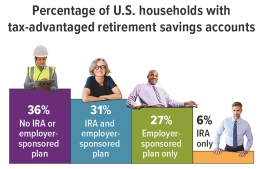

Source: Investment Company Institute, 2021

Contributions to employer-sponsored plans and traditional IRAs are generally made pre-tax or tax-deductible and accumulate tax-deferred. Distributions are taxed as ordinary income and may be subject to a 10% federal income tax penalty if withdrawn before age 59½ (with certain exceptions). Nondeductible contributions to a traditional IRA are not taxable when withdrawn, but any earnings are subject to ordinary income tax. Required minimum distributions (RMDs) from employer-sponsored plans and traditional IRAs must begin for the year you reach age 72 (70½ if you were born before July 1, 1949). However, you are generally not required to take distributions from an employer plan as long as you still work for that employer.

Roth IRA contributions are not deductible, but they can be withdrawn at any time without penalty or taxes. To qualify for the tax-free and penalty-free withdrawal of earnings, Roth IRA distributions must meet a five-year holding requirement and take place after age 59½ (with certain exceptions). Original owners of Roth IRAs are exempt from RMDs. However, beneficiaries of all IRAs and employer plans must take RMDs based on their age and relationship to the original owner.

1) Employee Benefit Research Institute, 2020

2) Other options when separating from an employer include leaving the assets in your former employer’s plan (if allowed), rolling them into a new employer’s plan, or cashing out (usually not wise).

3) If a workplace plan does not cover you, but your spouse is covered, eligibility phases out at MAGI of $198,000 to $208,000 for joint filers in 2021 ($204,000 to $214,000 in 2022).

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to ensure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other financial tips we can provide towards your financial well-being.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.