Presented by Steve LaFrance, CFP®

We’ve discussed the debt ceiling crisis in past articles, and now it’s back in the headlines. What does this mean, and why are we watching it now? Several months ago, the U.S. borrowed as much money as it’s legally allowed to borrow and, since then, has been prohibited from borrowing more. In the language of the headlines, we have hit the debt ceiling.

If that sounds like an awkward situation, it is. It also raises very real economic and market risks, which are being played out in the news. Let’s analyze in detail what this all means.

The Current Situation

The U.S. government runs a deficit, meaning it spends more than it brings in. So, it continually borrows more to pay the outstanding bills. The problem is that Congress has put a limit on the total amount the government can borrow, also known as the debt ceiling. Congress needs to raise that limit on a regular basis to account for approved deficit spending. Raising the debt limit has become a regular political football, which is why we’re having this conversation again. Congress has not raised the limit, and we have reached the debt ceiling again.

Once the debt limit is hit, the Treasury cannot issue any more debt but must keep paying the bills. There are “extraordinary measures,” tested in previous debt-limit confrontations, which would allow this to be done in the short term. These include shifting money among different government accounts to fill the gap until more borrowing is allowed. Two examples of this are affording the debt by suspending retirement contributions for government workers or repurposing other accounts normally used for things such as stabilizing the currency. The idea is that this will buy time for Congress to authorize more borrowing. This is where we are now, and where we have been for the past several months.

The Consequences If Congress Doesn’t Act

At a certain point—tentatively estimated to be around June or July, but this is very uncertain—the Treasury will run out of money to pay the bills. Among those bills are salaries for federal workers. So, at some point, the government will largely shut down. Some bills will get paid, but many government obligations will go unpaid.

Why We Should Care

Setting aside the political aspect of the situation, this affects investors for several reasons. First, cutting off government payments will hurt economic growth. Limits on social security payments, for example, would severely hurt economic demand and confidence. Although social security would likely be the last thing cut, other cuts would also hurt growth and confidence. We saw this in prior shutdowns, and the damage was real.

The bigger problem, however, is if payments to holders of U.S. debt are not made and the Treasury market goes into default. U.S. government debt has always been the ultimate low-risk asset, where default was assumed to be nearly impossible. Adding a default risk would raise interest rates, potentially costing the country billions over time. The economic risk, both immediate and long term, is very high—and that’s what the headlines are emphasizing.

Possible Solutions

We have been down this road before, and while the ending could be bad, we’ve resolved the problem every previous time. There are a few ways we could do this without systemic damage.

The easiest and most likely course of action is for Congress to cut a deal. At this point, it seems the group of Congresspeople really looking for an extended confrontation is quite small. If that’s true, a deal is very possible, and even likely, as pressure mounts.

On the other hand, if Congress cannot or will not come to an agreement, there are other ways the government can resolve the problem before it blows up. These range from the reasonably credible, such as using a line from the Fourteenth Amendment of the U.S. Constitution to justify ignoring the limit entirely, to the reasonable but iffy, such as issuing lower face value bonds with higher coupons. There are also borderline crazy solutions, such as issuing a $1 trillion coin. In short, there are many options other than default. As we saw in the financial crisis, the government is willing to do many things that were previously unimaginable to avoid a crisis, and I am quite certain that will be the case here as well.

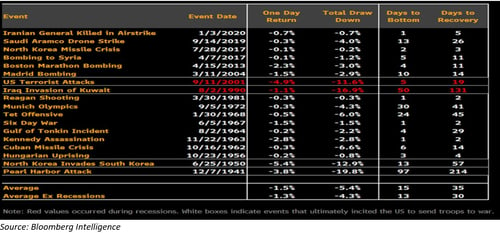

What Happens If We Default

Defaulting is not the end of the world, and here’s why. First, a default happened in 1971 for technical reasons. Since the reasons weren’t economic, investors looked through the default and the long-term consequences were minimal. Second, a default this time around also would not be economic; it would be political. When countries default because they can’t pay, that is a systemic problem—the lenders won’t be getting their money. In this case, though, we can and will pay. It will just take some time to get through the political process. If you think about it in personal terms, a late mortgage payment is quite different from foreclosure. No one is talking about repudiating or actually defaulting on U.S. debt over time, and the markets are reflecting that. Real default won’t happen, even if temporary default does

The Takeaway Message for Investors

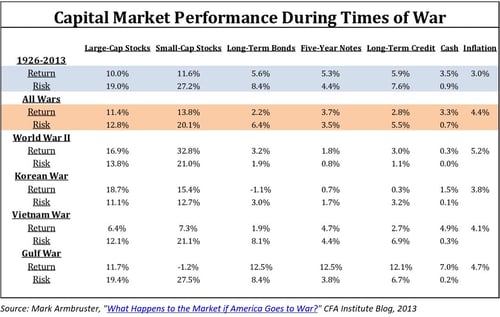

Don’t panic. This has happened before and will likely happen again. The headlines are making the most of potential consequences, and the worst case would indeed be bad. But there are enormous incentives to cut a deal before we reach the worst-case scenario. And even if a deal is not cut, there are other non-default options. If we do get to default, the likely market volatility will drive a deal at that time. Failure to solve this problem really isn’t an option.

This is a big deal, and worth watching, but not worth worrying about yet. We’ll be keeping an eye on it and writing about any developments. In the meantime, keep calm and carry on.

Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results.

###