In 2020, 31% of U.S. workers with employer-sponsored health insurance had a high-deductible health plan (HDHP), up from 24% in 2015.1 These plans are also available outside the workplace through private insurers and the Health Insurance Marketplace.

Up-Front Savings

The average annual employee premium for HDHP family coverage in 2020 was $4,852 versus $6,017 for a PPO, a savings of $1,165 per year.3 In addition, many employers contribute to a health savings account (HSA) for the employee, and contributions by the employer or the employee are tax-advantaged (see below). Taken together, these features could add up to substantial savings that can be used to pay for current and future medical expenses.

Pay As You Go

You pay more out of pocket for medical services with an HDHP until you reach the annual deductible in return for lower premiums.

Deductible: An HDHP has a higher deductible than a PPO. Still, PPO deductibles have been rising, so consider the difference between plan deductibles and whether the deductible is per person or family. PPOs may have a separate deductible (or no deductible) for prescription drugs, but the HDHP deductible will apply to all covered medical spending.

Copays: PPOs typically have copays that allow you to obtain certain services and prescription drugs with a defined payment before meeting your deductible. With an HDHP, you pay out of pocket until you meet your deductible, but the insurer’s negotiated rate may reduce costs. For example, consider the difference between the copay and the negotiated rate for a standard service such as a doctor visit – certain types of preventive care and preventive medicines may be provided at no cost under both types of plans.

Maximums: Most health insurance plans have annual and lifetime out-of-pocket maximums above which the insurer pays all medical expenses. HDHP maximums may be the same or similar to that of PPO plans. (Some PPO plans have a separate annual maximum for prescription drugs.) If you have high medical costs that exceed the yearly maximum, your total out-of-pocket costs for that year would typically be lower for an HDHP with the savings on premiums.

Your Choices and Preferences

Both PPOs and HDHPs offer incentives to use healthcare providers within a network, and the network may be identical if the same insurance company provides the plans. Make sure your preferred doctors are included in the network before enrolling.

Also, consider whether you are comfortable using the HDHP structure. Although it may save money over a year, you might be hesitant to obtain appropriate care because of the higher out-of-pocket expense at the time of service.

Health Savings Accounts

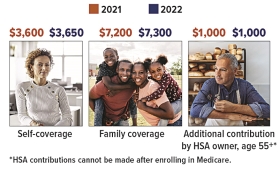

High-deductible health plans are designed to be paired with a tax-advantaged health savings account (HSA) that can be used to pay medical expenses incurred after the HSA is established. HSA contributions are typically made through pre-tax payroll deductions, but in most cases, they can also be made as tax-deductible contributions directly to the HSA provider. HSA funds, including any earnings if the account has an investment option, can be withdrawn free of federal income tax and penalties as long as the money is spent on qualified healthcare expenses. (Some states do not follow federal tax rules on HSAs.)

The assets in an HSA can be retained in the account or rolled over to a new HSA if you change employers or retire. In addition, unspent HSA balances can be used to pay future medical expenses whether you are enrolled in an HDHP or not; however, you must be enrolled in an HDHP to establish and contribute to an HSA.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Engage with the entire Blakely Financial team at WWW.BLAKELYFINANCIAL.COM to see what other expert advice we can provide towards your financial well-being.

ROBERT BLAKELY, CFP® is a financial advisor with BLAKELY FINANCIAL, INC. located at 1022 Hutton Ln., Suite 109, High Point, NC 27262. He is the founder and president of Blakely Financial, Inc.

Blakely Financial, Inc. is an independent financial planning and investment management firm that provides clarity, insight, and guidance to help our clients attain their financial goals.

Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Diversification and asset allocation programs do not assure a profit or protect against loss in declining markets, and cannot guarantee that any objective or goal will be achieved.